RESET

PRINT

FORM

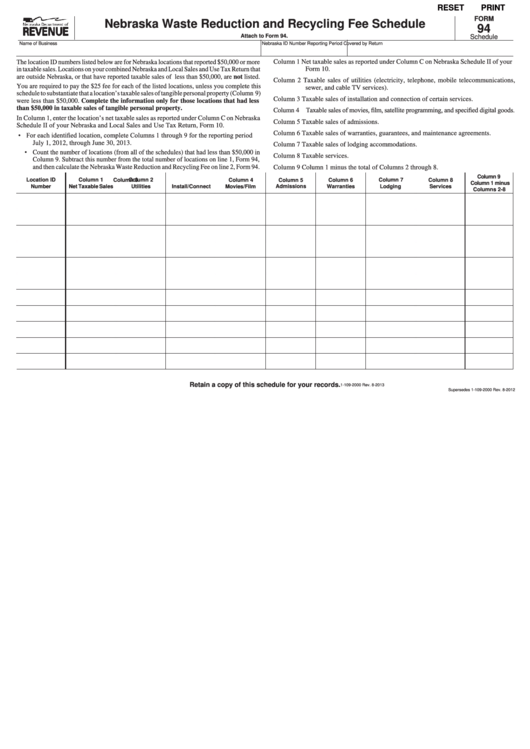

Nebraska Waste Reduction and Recycling Fee Schedule

94

Attach to Form 94.

Schedule

Name of Business

Nebraska ID Number

Reporting Period Covered by Return

The location ID numbers listed below are for Nebraska locations that reported $50,000 or more

Column 1 Net taxable sales as reported under Column C on Nebraska Schedule II of your

Form 10.

in taxable sales. Locations on your combined Nebraska and Local Sales and Use Tax Return that

are outside Nebraska, or that have reported taxable sales of less than $50,000, are not listed.

Column 2 Taxable sales of utilities (electricity, telephone, mobile telecommunications,

You are required to pay the $25 fee for each of the listed locations, unless you complete this

sewer, and cable TV services).

schedule to substantiate that a location’s taxable sales of tangible personal property (Column 9)

Column 3 Taxable sales of installation and connection of certain services.

were less than $50,000. Complete the information only for those locations that had less

than $50,000 in taxable sales of tangible personal property.

Column 4 Taxable sales of movies, film, satellite programming, and specified digital goods.

In Column 1, enter the location’s net taxable sales as reported under Column C on Nebraska

Column 5 Taxable sales of admissions.

Schedule II of your Nebraska and Local Sales and Use Tax Return, Form 10.

• For each identified location, complete Columns 1 through 9 for the reporting period

Column 6 Taxable sales of warranties, guarantees, and maintenance agreements.

July 1, 2012, through June 30, 2013.

Column 7 Taxable sales of lodging accommodations.

• Count the number of locations (from all of the schedules) that had less than $50,000 in

Column 8 Taxable services.

Column 9. Subtract this number from the total number of locations on line 1, Form 94,

and then calculate the Nebraska Waste Reduction and Recycling Fee on line 2, Form 94.

Column 9 Column 1 minus the total of Columns 2 through 8.

Column 9

Location ID

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Column 8

Column 1 minus

Number

Net Taxable Sales

Utilities

Install/Connect

Movies/Film

Warranties

Lodging

Services

Admissions

Columns 2-8

Retain a copy of this schedule for your records.

1-109-2000 Rev. 8-2013

Supersedes 1-109-2000 Rev. 8-2012

1

1 2

2