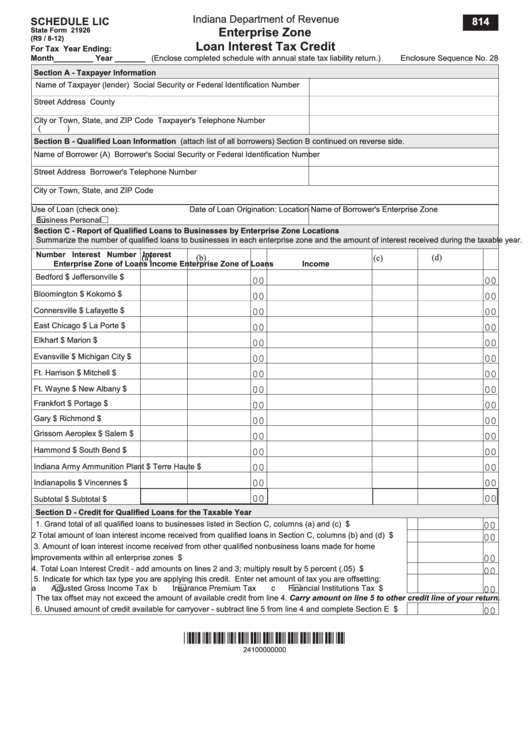

Indiana Department of Revenue

SCHEDULE LIC

814

Enterprise Zone

State Form 21926

(R9 / 8-12)

Loan Interest Tax Credit

For Tax Year Ending:

(Enclose completed schedule with annual state tax liability return.)

Enclosure Sequence No. 28

Month_________ Year _______

Section A - Taxpayer Information

Name of Taxpayer (lender)

Social Security or Federal Identification Number

Street Address

County

City or Town, State, and ZIP Code

Taxpayer's Telephone Number

(

)

Section B - Qualified Loan Information (attach list of all borrowers) Section B continued on reverse side.

Name of Borrower (A)

Borrower's Social Security or Federal Identification Number

Street Address

Borrower's Telephone Number

City or Town, State, and ZIP Code

Use of Loan (check one):

Date of Loan Origination:

Location Name of Borrower's Enterprise Zone

Business

Personal

Section C - Report of Qualified Loans to Businesses by Enterprise Zone Locations

Summarize the number of qualified loans to businesses in each enterprise zone and the amount of interest received during the taxable year.

Number

Interest

Number

Interest

(d)

(a)

(b)

(c)

Enterprise Zone

of Loans

Income

Enterprise Zone

of Loans

Income

Bedford

$

Jeffersonville

$

00

00

Bloomington

$

00

Kokomo

$

00

00

00

Connersville

$

Lafayette

$

00

00

East Chicago

$

La Porte

$

Elkhart

$

Marion

$

00

00

00

00

Evansville

$

Michigan City

$

00

00

Ft. Harrison

$

Mitchell

$

00

00

Ft. Wayne

$

New Albany

$

Frankfort

$

00

Portage

$

00

Gary

$

Richmond

$

00

00

Grissom Aeroplex

$

Salem

$

00

00

00

00

Hammond

$

South Bend

$

00

00

Indiana Army Ammunition Plant

$

Terre Haute

$

00

00

Indianapolis

$

Vincennes

$

00

00

Subtotal

$

Subtotal

$

Section D - Credit for Qualified Loans for the Taxable Year

00

1. Grand total of all qualified loans to businesses listed in Section C, columns (a) and (c) ............................ 1 $

2 Total amount of loan interest income received from qualified loans in Section C, columns (b) and (d) ........... 2 $

00

3. Amount of loan interest income received from other qualified nonbusiness loans made for home

00

improvements within all enterprise zones ................................................................................................... 3 $

4. Total Loan Interest Credit - add amounts on lines 2 and 3; multiply result by 5 percent (.05) .................... 4 $

00

5. Indicate for which tax type you are applying this credit. Enter net amount of tax you are offsetting:

00

a

Adjusted Gross Income Tax

b

Insurance Premium Tax

c

Financial Institutions Tax ....... 5 $

The tax offset may not exceed the amount of available credit from line 4. Carry amount on line 5 to other credit line of your return.

00

6. Unused amount of credit available for carryover - subtract line 5 from line 4 and complete Section E ...... 6 $

*24100000000*

24100000000

1

1 2

2 3

3 4

4