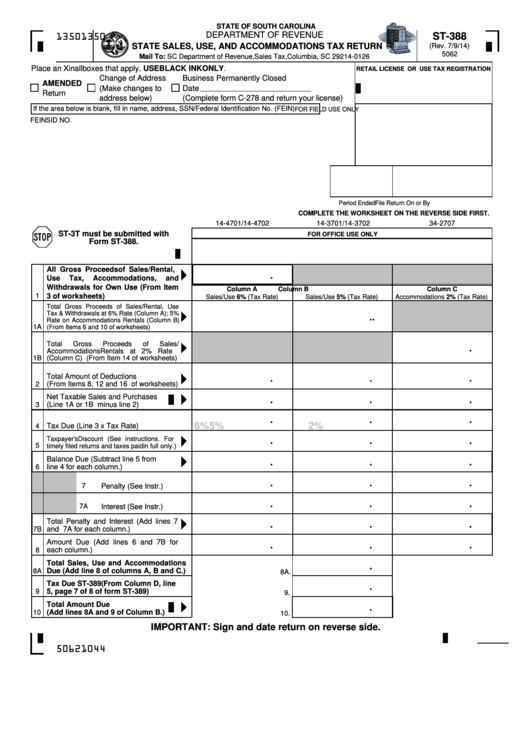

Form St-388 - State Sales, Use, And Accommodations Tax Return

ADVERTISEMENT

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

ST-388

1350

1350

STATE SALES, USE, AND ACCOMMODATIONS TAX RETURN

(Rev. 7/9/14)

5062

Mail To: SC Department of Revenue, Sales Tax, Columbia, SC 29214-0126

Place an X in all boxes that apply. USE BLACK INK ONLY.

RETAIL LICENSE OR USE TAX REGISTRATION

Change of Address

Business Permanently Closed

AMENDED

(Make changes to

Date

Return

address below)

(Complete form C-278 and return your license)

If the area below is blank, fill in name, address, SSN/Federal Identification No. (FEIN)

FOR FIELD USE ONLY

FEIN

SID NO.

Period Ended

File Return On or By

COMPLETE THE WORKSHEET ON THE REVERSE SIDE FIRST.

14-4701/14-4702

14-3701/14-3702

34-2707

ST-3T must be submitted with

FOR OFFICE USE ONLY

Form ST-388.

All Gross Proceeds of Sales/Rental,

.

Use

Tax,

Accommodations,

and

Withdrawals for Own Use (From Item

Column A

Column B

Column C

1

3 of worksheets)

Sales/Use 6% (Tax Rate)

Sales/Use 5% (Tax Rate)

Accommodations 2% (Tax Rate)

Total Gross Proceeds of Sales/Rental, Use

Tax & Withdrawals at 6% Rate (Column A); 5%

.

.

Rate on Accommodations Rentals (Column B)

1A

(From Items 6 and 10 of worksheets)

Total

Gross

Proceeds

of

Sales/

.

Accommodations Rentals at 2% Rate

(Column C) (From Item 14 of worksheets)

1B

Total Amount of Deductions

.

.

.

2

(From Items 8, 12 and 16 of worksheets)

Net Taxable Sales and Purchases

.

.

.

(Line 1A or 1B minus line 2)

3

.

.

.

6%

5%

2%

Tax Due (Line 3 x Tax Rate)

4

Taxpayer's Discount (See instructions. For

.

.

.

5

timely filed returns and taxes paid in full only.)

Balance Due (Subtract line 5 from

.

.

.

line 4 for each column.)

6

.

.

.

7

Penalty (See Instr.)

.

.

.

7A

Interest (See Instr.)

Total Penalty and Interest (Add lines 7

.

.

.

and 7A for each column.)

7B

Amount Due (Add lines 6 and 7B for

.

.

.

8

each column.)

Total Sales, Use and Accommodations

.

Due (Add line 8 of columns A, B and C.)

8A

8A.

Tax Due ST-389 (From Column D, line

.

5, page 7 of 8 of form ST-389)

9

9.

Total Amount Due

.

10

(Add lines 8A and 9 of Column B.)

10.

IMPORTANT: Sign and date return on reverse side.

50621044

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3