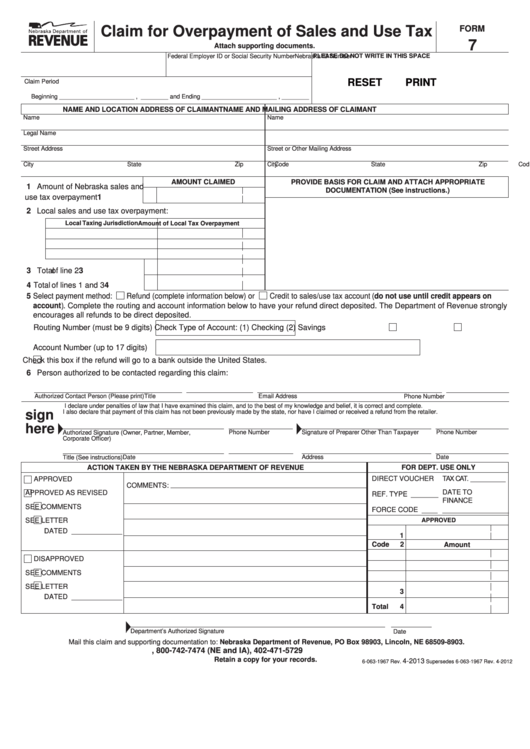

Claim for Overpayment of Sales and Use Tax

FORM

7

Attach supporting documents.

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska ID Number

Federal Employer ID or Social Security Number

Claim Period

RESET

PRINT

Beginning ______________________ , ________ and Ending ______________________ , ________

NAME AND LOCATION ADDRESS OF CLAIMANT

NAME AND MAILING ADDRESS OF CLAIMANT

Name

Name

Legal Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

AMOUNT CLAIMED

PROVIDE BASIS FOR CLAIM AND ATTACH APPROPRIATE

1 Amount of Nebraska sales and

DOCUMENTATION (See instructions.)

use tax overpayment . . . . . .

1

2 Local sales and use tax overpayment:

Local Taxing Jurisdiction

Amount of Local Tax Overpayment

3 Total of line 2. . . . . . . . . . . . . .

3

4 Total of lines 1 and 3 . . . . . . . .

4

5 Select payment method:

Refund (complete information below) or

Credit to sales/use tax account (do not use until credit appears on

account). Complete the routing and account information below to have your refund direct deposited. The Department of Revenue strongly

encourages all refunds to be direct deposited.

Routing Number (must be 9 digits)

Check Type of Account:

(1) Checking

(2) Savings

Account Number (up to 17 digits)

Check this box if the refund will go to a bank outside the United States.

6 Person authorized to be contacted regarding this claim:

Authorized Contact Person (Please print)

Title

Email Address

Phone Number

I declare under penalties of law that I have examined this claim, and to the best of my knowledge and belief, it is correct and complete.

sign

I also declare that payment of this claim has not been previously made by the state, nor have I claimed or received a refund from the retailer.

here

Authorized Signature (Owner, Partner, Member,

Phone Number

Signature of Preparer Other Than Taxpayer

Phone Number

Corporate Officer)

Date

Address

Date

Title (See instructions)

FOR DEPT. USE ONLY

ACTION TAKEN BY THE NEBRASKA DEPARTMENT OF REVENUE

DIRECT VOUCHER

TAX CAT. _________

APPROVED

COMMENTS:

DATE TO

APPROVED AS REVISED

REF. TYPE _______

FINANCE

SEE COMMENTS

_________________

FORCE CODE ____

SEE LETTER

APPROVED

DATED _____________

1

Code

2

Amount

DISAPPROVED

SEE COMMENTS

SEE LETTER

3

DATED _____________

Total

4

Department’s Authorized Signature

Date

Mail this claim and supporting documentation to: Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903.

, 800-742-7474 (NE and IA), 402-471-5729

Retain a copy for your records.

4-2013

6-063-1967 Rev.

Supersedes 6-063-1967 Rev. 4-2012

1

1 2

2 3

3