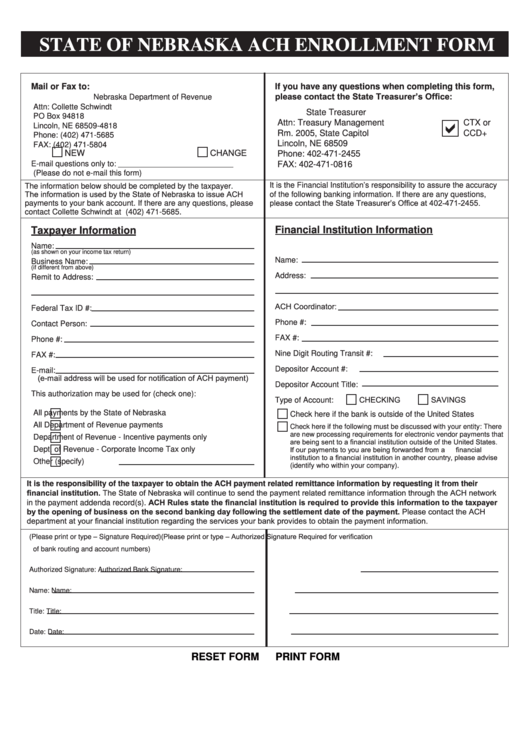

STATE OF NEBRASKA ACH ENROLLMENT FORM

Mail or Fax to:

If you have any questions when completing this form,

please contact the State Treasurer’s Office:

Nebraska Department of Revenue

Attn: Collette Schwindt

State Treasurer

PO Box 94818

a

Attn: Treasury Management

CTX or

Lincoln, NE 68509-4818

Rm. 2005, State Capitol

CCD+

Phone: (402) 471-5685

Lincoln, NE 68509

FAX: (402) 471-5804

CHANGE

NEW

Phone: 402-471-2455

E-mail questions only to: Collette.Schwindt@nebraska.gov

FAX: 402-471-0816

(Please do not e-mail this form)

It is the Financial Institution’s responsibility to assure the accuracy

The information below should be completed by the taxpayer.

The information is used by the State of Nebraska to issue ACH

of the following banking information. If there are any questions,

please contact the State Treasurer’s Office at 402-471-2455.

payments to your bank account. If there are any questions, please

contact Collette Schwindt at (402) 471-5685.

Financial Institution Information

Taxpayer Information

Name:

(as shown on your income tax return)

Name:

Business Name:

(if different from above)

Address:

Remit to Address:

ACH Coordinator:

Federal Tax ID #:

Phone #:

Contact Person:

FAX #:

Phone #:

Nine Digit Routing Transit #:

FAX #:

Depositor Account #:

E-mail:

(e-mail address will be used for notification of ACH payment)

Depositor Account Title:

This authorization may be used for (check one):

CHECKING

SAVINGS

Type of Account:

All payments by the State of Nebraska

Check here if the bank is outside of the United States

All Department of Revenue payments

Check here if the following must be discussed with your entity: There

Department of Revenue - Incentive payments only

are new processing requirements for electronic vendor payments that

are being sent to a financial institution outside of the United States.

If our payments to you are being forwarded from a U.S. financial

Dept. of Revenue - Corporate Income Tax only

institution to a financial institution in another country, please advise

Other (specify)

(identify who within your company).

It is the responsibility of the taxpayer to obtain the ACH payment related remittance information by requesting it from their

financial institution. The State of Nebraska will continue to send the payment related remittance information through the ACH network

in the payment addenda record(s). ACH Rules state the financial institution is required to provide this information to the taxpayer

by the opening of business on the second banking day following the settlement date of the payment. Please contact the ACH

department at your financial institution regarding the services your bank provides to obtain the payment information.

(Please print or type – Authorized Signature Required for verification

(Please print or type – Signature Required)

of bank routing and account numbers)

Authorized Signature:

Authorized Bank Signature:

Name:

Name:

Title:

Title:

Date:

Date:

RESET FORM

PRINT FORM

1

1