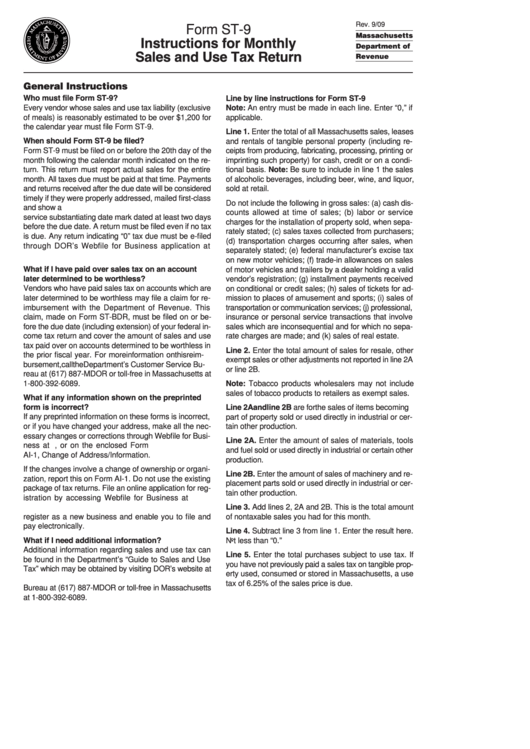

Instructions For Form St-9 - Monthly Sales And Use Tax Return - 2009

ADVERTISEMENT

Rev. 9/09

Form ST-9

Massachusetts

Instructions for Monthly

Department of

Sales and Use Tax Return

Revenue

General Instructions

Who must file Form ST-9?

Line by line instructions for Form ST-9

Every vendor whose sales and use tax liability (exclusive

Note: An entry must be made in each line. Enter “0,” if

of meals) is reasonably estimated to be over $1,200 for

applicable.

the calendar year must file Form ST-9.

Line 1. Enter the total of all Massachusetts sales, leases

When should Form ST-9 be filed?

and rentals of tangible personal property (including re-

Form ST-9 must be filed on or before the 20th day of the

ceipts from producing, fabricating, processing, printing or

month following the calendar month indicated on the re-

imprinting such property) for cash, credit or on a condi-

turn. This return must report actual sales for the entire

tional basis. Note: Be sure to include in line 1 the sales

month. All taxes due must be paid at that time. Payments

of alcoholic beverages, including beer, wine, and liquor,

and returns received after the due date will be considered

sold at retail.

timely if they were properly addressed, mailed first-class

Do not include the following in gross sales: (a) cash dis-

and show a U.S. Post Office postmark or private delivery

counts allowed at time of sales; (b) labor or service

service substantiating date mark dated at least two days

charges for the installation of property sold, when sepa-

before the due date. A return must be filed even if no tax

rately stated; (c) sales taxes collected from purchasers;

is due. Any return indicating “0” tax due must be e-filed

(d) transportation charges occurring after sales, when

through DOR’s Webfile for Business application at

separately stated; (e) federal manufacturer’s excise tax

on new motor vehicles; (f) trade-in allowances on sales

What if I have paid over sales tax on an account

of motor vehicles and trailers by a dealer holding a valid

later determined to be worthless?

vendor’s registration; (g) installment payments received

Vendors who have paid sales tax on accounts which are

on conditional or credit sales; (h) sales of tickets for ad-

later determined to be worthless may file a claim for re-

mission to places of amusement and sports; (i) sales of

imbursement with the Department of Revenue. This

transportation or communication services; (j) professional,

claim, made on Form ST-BDR, must be filed on or be-

insurance or personal service transactions that involve

fore the due date (including extension) of your federal in-

sales which are inconsequential and for which no sepa-

come tax return and cover the amount of sales and use

rate charges are made; and (k) sales of real estate.

tax paid over on accounts determined to be worthless in

Line 2. Enter the total amount of sales for resale, other

the prior fiscal year. For more information on this reim-

exempt sales or other adjustments not reported in line 2A

bursement, call the Department’s Customer Service Bu-

or line 2B.

reau at (617) 887-MDOR or toll-free in Massachusetts at

1-800-392-6089.

Note: Tobacco products wholesalers may not include

sales of tobacco products to retailers as exempt sales.

What if any information shown on the preprinted

form is incorrect?

Line 2A and line 2B are for the sales of items becoming

If any preprinted information on these forms is incorrect,

part of property sold or used directly in industrial or cer-

or if you have changed your address, make all the nec-

tain other production.

essary changes or corrections through Webfile for Busi-

Line 2A. Enter the amount of sales of materials, tools

ness at , or on the enclosed Form

and fuel sold or used directly in industrial or certain other

AI-1, Change of Address/Information.

production.

If the changes involve a change of ownership or organi-

Line 2B. Enter the amount of sales of machinery and re-

zation, report this on Form AI-1. Do not use the existing

placement parts sold or used directly in industrial or cer-

package of tax returns. File an online application for reg-

tain other production.

istration by accessing Webfile for Business at www.

mass.gov/dor. The online application will allow you to

Line 3. Add lines 2, 2A and 2B. This is the total amount

register as a new business and enable you to file and

of nontaxable sales you had for this month.

pay electronically.

Line 4. Subtract line 3 from line 1. Enter the result here.

What if I need additional information?

Not less than “0.”

Additional information regarding sales and use tax can

Line 5. Enter the total purchases subject to use tax. If

be found in the Department’s “Guide to Sales and Use

you have not previously paid a sales tax on tangible prop-

Tax” which may be obtained by visiting DOR’s website at

erty used, consumed or stored in Massachusetts, a use

or by calling the Customer Service

tax of 6.25% of the sales price is due.

Bureau at (617) 887-MDOR or toll-free in Massachusetts

at 1-800-392-6089.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2