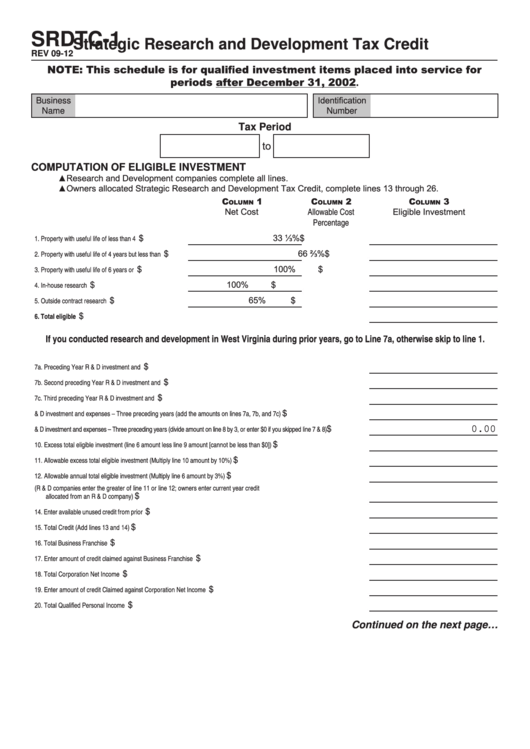

SRDTC-1

Strategic Research and Development Tax Credit

REV 09-12

NOTE: This schedule is for qualified investment items placed into service for

periods after December 31, 2002.

Identification

Business

Name

Number

Tax Period

to

COMPUTATION OF ELIGIBLE INVESTMENT

▲ Research and Development companies complete all lines.

▲ Owners allocated Strategic Research and Development Tax Credit, complete lines 13 through 26.

C

1

C

2

C

3

olumn

olumn

olumn

Allowable Cost

Net Cost

Eligible Investment

Percentage

33 ⅓%

1. Property with useful life of less than 4 years....................

$

$

66 ⅔%

2. Property with useful life of 4 years but less than 6...........

$

$

100%

3. Property with useful life of 6 years or more......................

$

$

100%

4. In-house research expenses............................................

$

$

65%

5. Outside contract research expense.................................

$

$

6. Total eligible investment.................................................................................................................................................................

$

If you conducted research and development in West Virginia during prior years, go to Line 7a, otherwise skip to line 1.

7a. Preceding Year R & D investment and expenses.............................................................................................................................

$

7b. Second preceding Year R & D investment and expenses.................................................................................................................

$

7c. Third preceding Year R & D investment and expenses.....................................................................................................................

$

8. Total R & D investment and expenses – Three preceding years (add the amounts on lines 7a, 7b, and 7c)...................................

$

9. Average R & D investment and expenses – Three preceding years (divide amount on line 8 by 3, or enter $0 if you skipped line 7 & 8)

0.00

$

10. Excess total eligible investment (line 6 amount less line 9 amount [cannot be less than $0])........................................................

$

11. Allowable excess total eligible investment (Multiply line 10 amount by 10%)..................................................................................

$

12. Allowable annual total eligible investment (Multiply line 6 amount by 3%)......................................................................................

$

13. Amount of current year credit Allowed (R & D companies enter the greater of line 11 or line 12; owners enter current year credit

allocated from an R & D company)..................................................................................................................................................

$

14. Enter available unused credit from prior years...................................................................................................................................

$

15. Total Credit (Add lines 13 and 14).....................................................................................................................................................

$

16. Total Business Franchise Tax............................................................................................................................................................

$

17. Enter amount of credit claimed against Business Franchise Tax......................................................................................................

$

18. Total Corporation Net Income Tax.....................................................................................................................................................

$

19. Enter amount of credit Claimed against Corporation Net Income Tax.............................................................................................

$

20. Total Qualified Personal Income Tax.................................................................................................................................................

$

Continued on the next page…

1

1 2

2 3

3 4

4 5

5 6

6