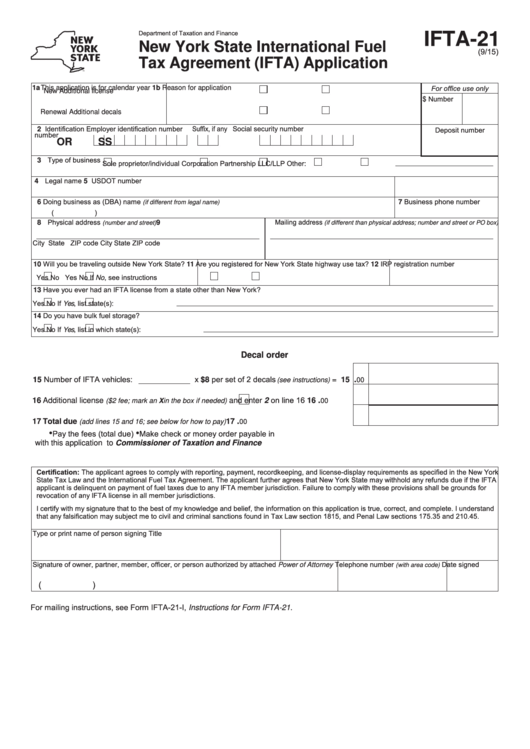

Form Ifta-21 - New York State International Fuel Tax Agreement (Ifta) Application - 2015

ADVERTISEMENT

Department of Taxation and Finance

IFTA-21

New York State International Fuel

(9/15)

Tax Agreement (IFTA) Application

For office use only

1a This application is for calendar year

1b Reason for application

New

Additional license

$

Number

Renewal

Additional decals

2 Identification

Employer identification number Suffix, if any

Social security number

Deposit number

number

OR

SS

3 Type of business

Sole proprietor/individual

Corporation

Partnership

LLC/LLP

Other:

4 Legal name

5 USDOT number

6 Doing business as (DBA) name

7 Business phone number

(if different from legal name)

(

)

8 Physical address

9 Mailing address

(number and street)

(if different than physical address; number and street or PO box)

City

State

ZIP code

City

State

ZIP code

10 Will you be traveling outside New York State?

11 Are you registered for New York State highway use tax?

12 IRP registration number

Yes

No

Yes

No

If No, see instructions

13 Have you ever had an IFTA license from a state other than New York?

Yes

No

If Yes, list state(s):

14 Do you have bulk fuel storage?

Yes

No

If Yes, list in which state(s):

Decal order

15 Number of IFTA vehicles:

x $8 per set of 2 decals

.

= ...... 15

(see instructions)

00

and enter 2 on line 16 ......... 16

.

16 Additional license

($2 fee; mark an X in the box if needed)

00

.

17 Total due

............................................ 17

(add lines 15 and 16; see below for how to pay)

00

•

•

Pay the fees (total due)

Make check or money order payable in U.S. funds

with this application

to Commissioner of Taxation and Finance

Certification: The applicant agrees to comply with reporting, payment, recordkeeping, and license-display requirements as specified in the New York

State Tax Law and the International Fuel Tax Agreement. The applicant further agrees that New York State may withhold any refunds due if the IFTA

applicant is delinquent on payment of fuel taxes due to any IFTA member jurisdiction. Failure to comply with these provisions shall be grounds for

revocation of any IFTA license in all member jurisdictions.

I certify with my signature that to the best of my knowledge and belief, the information on this application is true, correct, and complete. I understand

that any falsification may subject me to civil and criminal sanctions found in Tax Law section 1815, and Penal Law sections 175.35 and 210.45.

Type or print name of person signing

Title

Signature of owner, partner, member, officer, or person authorized by attached Power of Attorney

Telephone number

Date signed

(with area code)

(

)

For mailing instructions, see Form IFTA-21-I, Instructions for Form IFTA-21.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1