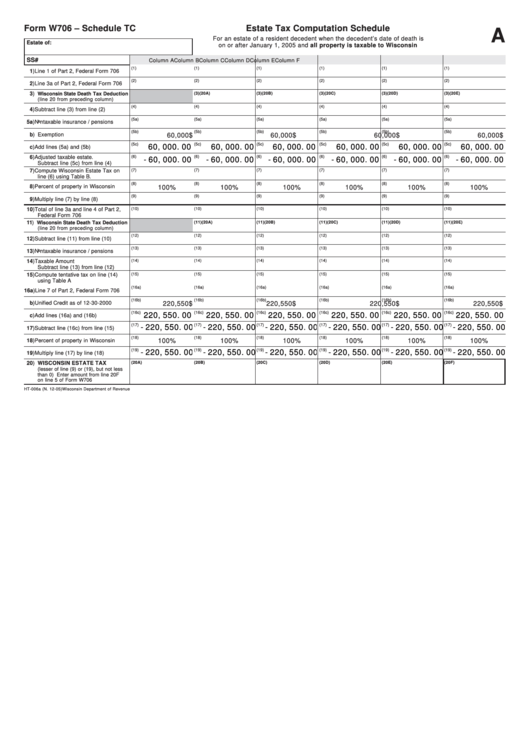

Form W706 – Schedule TC

Estate Tax Computation Schedule

A

For an estate of a resident decedent when the decedent’s date of death is

Estate of:

on or after January 1, 2005 and all property is taxable to Wisconsin

SS#

Column A

Column B

Column C

Column D

Column E

Column F

(1)

(1)

(1)

(1)

(1)

(1)

1) Line 1 of Part 2, Federal Form 706

(2)

(2)

(2)

(2)

(2)

(2)

2) Line 3a of Part 2, Federal Form 706

3)

Wisconsin State Death Tax Deduction

(3)(20A)

(3)(20B)

(3)(20C)

(3)(20D)

(3)(20E)

(line 20 from preceding column)

(4)

(4)

(4)

(4)

(4)

(4)

4) Subtract line (3) from line (2)

(5a)

(5a)

(5a)

(5a)

(5a)

(5a)

5a) Nontaxable insurance / pensions

(5b)

(5b)

(5b)

(5b)

(5b)

(5b)

b) Exemption

$

60,000

$

60,000

$

60,000

$

60,000

$

60,000

$

60,000

(5c)

60,000.00

(5c)

60,000.00

(5c)

60,000.00

(5c)

60,000.00

(5c)

60,000.00

(5c)

60,000.00

c) Add lines (5a) and (5b)

6) Adjusted taxable estate.

(6)

(6)

(6)

(6)

(6)

(6)

-60,000.00

-60,000.00

-60,000.00

-60,000.00

-60,000.00

-60,000.00

Subtract line (5c) from line (4)

7) Compute Wisconsin Estate Tax on

(7)

(7)

(7)

(7)

(7)

(7)

line (6) using Table B.

(8)

(8)

(8)

(8)

(8)

(8)

8) Percent of property in Wisconsin

100%

100%

100%

100%

100%

100%

(9)

(9)

(9)

(9)

(9)

(9)

9) Multiply line (7) by line (8)

10) Total of line 3a and line 4 of Part 2,

(10)

(10)

(10)

(10)

(10)

(10)

Federal Form 706

11)

Wisconsin State Death Tax Deduction

(11)(20A)

(11)(20B)

(11)(20C)

(11)(20D)

(11)(20E)

(line 20 from preceding column)

(12)

(12)

(12)

(12)

(12)

(12)

12) Subtract line (11) from line (10)

(13)

(13)

(13)

(13)

(13)

(13)

13) Nontaxable insurance / pensions

14) Taxable Amount

(14)

(14)

(14)

(14)

(14)

(14)

Subtract line (13) from line (12)

15) Compute tentative tax on line (14)

(15)

(15)

(15)

(15)

(15)

(15)

using Table A

(16a)

(16a)

(16a)

(16a)

(16a)

(16a)

16a) Line 7 of Part 2, Federal Form 706

(16b)

(16b)

(16b)

(16b)

(16b)

(16b)

b) Unified Credit as of 12-30-2000

$

220,550

$

220,550

$

220,550

$

220,550

$

220,550

$

220,550

(16c)

(16c)

(16c)

(16c)

(16c)

(16c)

220,550.00

220,550.00

220,550.00

220,550.00

220,550.00

220,550.00

c) Add lines (16a) and (16b)

(17)

-220,550.00

(17)

-220,550.00

(17)

-220,550.00

(17)

-220,550.00

(17)

-220,550.00

(17)

-220,550.00

17) Subtract line (16c) from line (15)

(18)

(18)

(18)

(18)

(18)

(18)

18) Percent of property in Wisconsin

100%

100%

100%

100%

100%

100%

-220,550.00

-220,550.00

-220,550.00

-220,550.00

-220,550.00

-220,550.00

(19)

(19)

(19)

(19)

(19)

(19)

19) Multiply line (17) by line (18)

20) WISCONSIN ESTATE TAX

(20A)

(20B)

(20C)

(20D)

(20E)

(20F)

(lesser of line (9) or (19), but not less

than 0) Enter amount from line 20F

on line 5 of Form W706

HT-006a (N. 12-05)

Wisconsin Department of Revenue

1

1