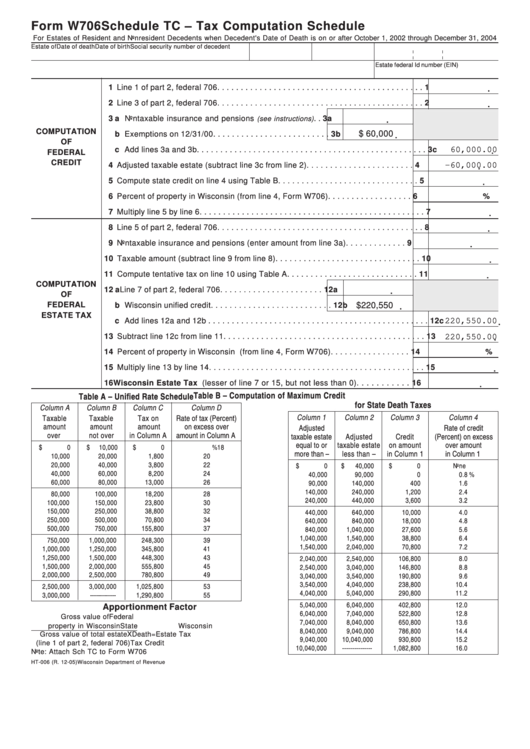

Form W706

Schedule TC – Tax Computation Schedule

For Estates of Resident and Nonresident Decedents when Decedent's Date of Death is on or after October 1, 2002 through December 31, 2004

Estate of

Date of death

Date of birth

Social security number of decedent

Estate federal Id number (EIN)

1 Line 1 of part 2, federal 706 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

.

2 Line 3 of part 2, federal 706 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.

3 a Nontaxable insurance and pensions

. . 3a

(see instructions)

.

COMPUTATION

$ 60,000

b Exemptions on 12/31/00 . . . . . . . . . . . . . . . . . . . . . . . . . 3b

.

OF

60,000.00

c Add lines 3a and 3b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3c

.

FEDERAL

CREDIT

4 Adjusted taxable estate (subtract line 3c from line 2) . . . . . . . . . . . . . . . . . . . . . . .

4

-60,000.00

.

5 Compute state credit on line 4 using Table B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

6 Percent of property in Wisconsin (from line 4, Form W706) . . . . . . . . . . . . . . . . . .

6

%

7 Multiply line 5 by line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

8 Line 5 of part 2, federal 706 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.

9 Nontaxable insurance and pensions (enter amount from line 3a) . . . . . . . . . . . . .

9

.

10 Taxable amount (subtract line 9 from line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

11 Compute tentative tax on line 10 using Table A . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

COMPUTATION

12 a Line 7 of part 2, federal 706 . . . . . . . . . . . . . . . . . . . . . . 12a

.

OF

FEDERAL

$220,550

b Wisconsin unified credit . . . . . . . . . . . . . . . . . . . . . . . . . . 12b

.

ESTATE TAX

220,550.00

c Add lines 12a and 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12c

.

13 Subtract line 12c from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

220,550.00

.

14 Percent of property in Wisconsin (from line 4, Form W706) . . . . . . . . . . . . . . . . . 14

%

15 Multiply line 13 by line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.

16 Wisconsin Estate Tax (lesser of line 7 or 15, but not less than 0) . . . . . . . . . . . 16

.

Table B – Computation of Maximum Credit

Table A – Unified Rate Schedule

for State Death Taxes

Column A

Column B

Column C

Column D

Column 1

Column 2

Column 3

Column 4

Taxable

Taxable

Tax on

Rate of tax (Percent)

amount

amount

amount

on excess over

Adjusted

Rate of credit

over

not over

in Column A

amount in Column A

taxable estate

Adjusted

Credit

(Percent) on excess

equal to or

taxable estate

on amount

over amount

$

0

$

10,000

$

0

18

%

more than –

less than –

in Column 1

in Column 1

10,000

20,000

1,800

20

20,000

40,000

3,800

22

$

0

$

40,000

$

0

None

40,000

60,000

8,200

24

40,000

90,000

0

0.8

%

60,000

80,000

13,000

26

90,000

140,000

400

1.6

140,000

240,000

1,200

2.4

80,000

100,000

18,200

28

240,000

440,000

3,600

3.2

100,000

150,000

23,800

30

150,000

250,000

38,800

32

440,000

640,000

10,000

4.0

250,000

500,000

70,800

34

640,000

840,000

18,000

4.8

500,000

750,000

155,800

37

840,000

1,040,000

27,600

5.6

1,040,000

1,540,000

38,800

6.4

750,000

1,000,000

248,300

39

1,540,000

2,040,000

70,800

7.2

1,000,000

1,250,000

345,800

41

1,250,000

1,500,000

448,300

43

2,040,000

2,540,000

106,800

8.0

1,500,000

2,000,000

555,800

45

2,540,000

3,040,000

146,800

8.8

2,000,000

2,500,000

780,800

49

3,040,000

3,540,000

190,800

9.6

3,540,000

4,040,000

238,800

10.4

2,500,000

3,000,000

1,025,800

53

4,040,000

5,040,000

290,800

11.2

3,000,000

-------------

1,290,800

55

5,040,000

6,040,000

402,800

12.0

Apportionment Factor

6,040,000

7,040,000

522,800

12.8

Gross value of

Federal

7,040,000

8,040,000

650,800

13.6

property in Wisconsin

State

Wisconsin

8,040,000

9,040,000

786,800

14.4

Gross value of total estate

X

Death

=

Estate Tax

9,040,000

10,040,000

930,800

15.2

(line 1 of part 2, federal 706)

Tax Credit

10,040,000

---------------

1,082,800

16.0

Note: Attach Sch TC to Form W706

HT-006 (R. 12-05)

Wisconsin Department of Revenue

1

1