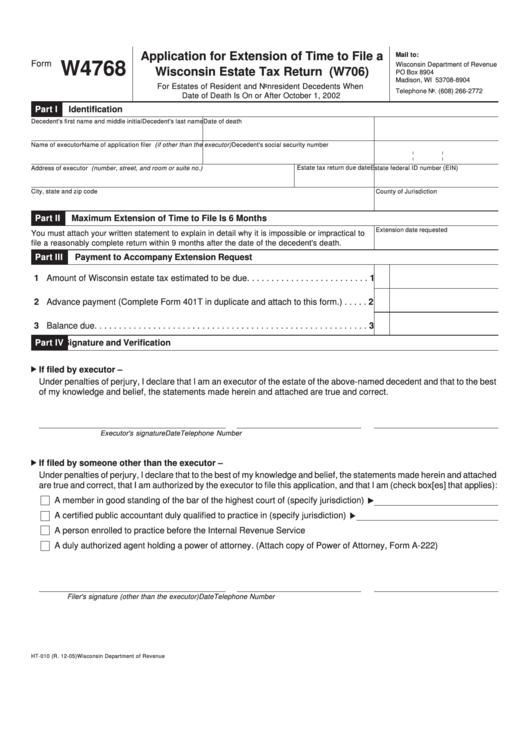

Form W4768 - Application For Extension Of Time To File A Wisconsin Estate Tax Return (W706)

ADVERTISEMENT

Application for Extension of Time to File a

Mail to:

Form

W4768

Wisconsin Department of Revenue

Wisconsin Estate Tax Return (W706)

PO Box 8904

Madison, WI 53708-8904

For Estates of Resident and Nonresident Decedents When

Telephone No. (608) 266-2772

Date of Death Is On or After October 1, 2002

Part I

Identification

Decedent's first name and middle initial

Decedent's last name

Date of death

Name of executor

Name of application filer (if other than the executor)

Decedent's social security number

Address of executor (number, street, and room or suite no.)

Estate tax return due date Estate federal ID number (EIN)

City, state and zip code

County of Jurisdiction

Part II

Maximum Extension of Time to File Is 6 Months

Extension date requested

You must attach your written statement to explain in detail why it is impossible or impractical to

file a reasonably complete return within 9 months after the date of the decedent's death.

Part III

Payment to Accompany Extension Request

1 Amount of Wisconsin estate tax estimated to be due . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Advance payment (Complete Form 401T in duplicate and attach to this form.) . . . . .

2

3 Balance due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Part IV

Signature and Verification

If filed by executor –

Under penalties of perjury, I declare that I am an executor of the estate of the above-named decedent and that to the best

of my knowledge and belief, the statements made herein and attached are true and correct.

Executor's signature

Date

Telephone Number

If filed by someone other than the executor –

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein and attached

are true and correct, that I am authorized by the executor to file this application, and that I am (check box[es] that applies):

A member in good standing of the bar of the highest court of (specify jurisdiction)

A certified public accountant duly qualified to practice in (specify jurisdiction)

A person enrolled to practice before the Internal Revenue Service

A duly authorized agent holding a power of attorney. (Attach copy of Power of Attorney, Form A-222)

Filer's signature (other than the executor)

Date

Telephone Number

HT-010 (R. 12-05)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1