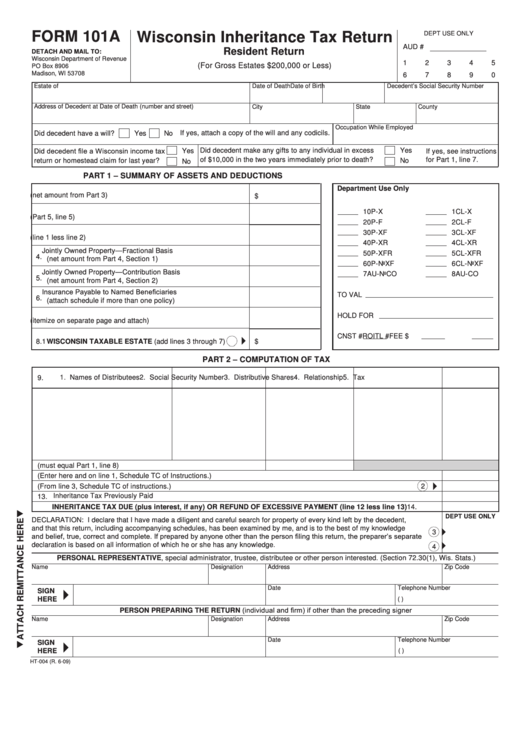

FORM 101A

Wisconsin Inheritance Tax Return

DEPT USE ONLY

AUD #

Resident Return

DETACH AND MAIL TO:

Wisconsin Department of Revenue

1

2

3

4

5

(For Gross Estates $200,000 or Less)

PO Box 8906

Madison, WI 53708

6

7

8

9

0

Estate of

Date of Death

Date of Birth

Decedent’s Social Security Number

Address of Decedent at Date of Death (number and street)

City

State

County

Occupation While Employed

If yes, attach a copy of the will and any codicils.

Did decedent have a will?

Yes

No

Did decedent file a Wisconsin income tax

Did decedent make any gifts to any individual in excess

Yes

Yes

If yes, see instructions

for Part 1, line 7.

of $10,000 in the two years immediately prior to death?

return or homestead claim for last year?

No

No

PART 1 – SUMMARY OF ASSETS AND DEDUCTIONS

Department Use Only

1. Property Solely Owned by Decedent (net amount from Part 3)

$

10P-X

1CL-X

2. Allowable Deductions (Part 5, line 5)

20P-F

2CL-F

30P-XF

3CL-XF

3. Subtotal (line 1 less line 2)

40P-XR

4CL-XR

Jointly Owned Property—Fractional Basis

50P-XFR

5CL-XFR

4.

(net amount from Part 4, Section 1)

60P-NoXF

6CL-NoXF

Jointly Owned Property—Contribution Basis

7AU-NoCO

8AU-CO

5.

(net amount from Part 4, Section 2)

Insurance Payable to Named Beneficiaries

TO VAL

6.

(attach schedule if more than one policy)

HOLD FOR

7. Other Property (itemize on separate page and attach)

CNST #

ROITL #

FEE $

}

8.

WISCONSIN TAXABLE ESTATE (add lines 3 through 7)

1

$

PART 2 – COMPUTATION OF TAX

1. Names of Distributees

2. Social Security Number

3. Distributive Shares

4. Relationship

5. Tax

9.

10. Total Distributive Shares (must equal Part 1, line 8)

11. Total of Column 5. (Enter here and on line 1, Schedule TC of Instructions.)

}

12. Inheritance Tax Payable (From line 3, Schedule TC of instructions.)

2

13. Inheritance Tax Previously Paid

14.

INHERITANCE TAX DUE (plus interest, if any) OR REFUND OF EXCESSIVE PAYMENT (line 12 less line 13)

$

„

DEPT USE ONLY

DECLARATION: I declare that I have made a diligent and careful search for property of every kind left by the decedent,

and that this return, including accompanying schedules, has been examined by me, and is to the best of my knowledge

}

3

and belief, true, correct and complete. If prepared by anyone other than the person filing this return, the preparer’s separate

}

declaration is based on all information of which he or she has any knowledge.

4

PERSONAL REPRESENTATIVE, special administrator, trustee, distributee or other person interested. (Section 72.30(1), Wis. Stats.)

Name

Designation

Address

Zip Code

Date

Telephone Number

}

SIGN

HERE

(

)

PERSON PREPARING THE RETURN (individual and firm) if other than the preceding signer

Name

Designation

Address

Zip Code

Date

Telephone Number

„

}

SIGN

HERE

(

)

HT-004 (R. 6-09)

1

1 2

2 3

3 4

4