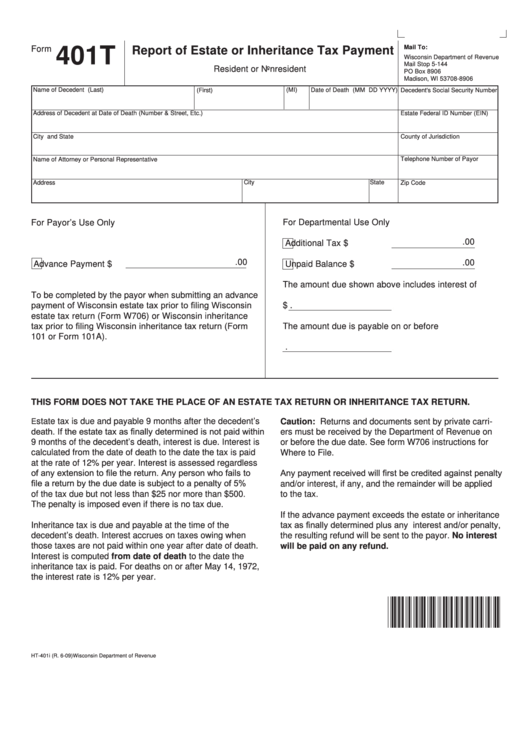

Form 401t - Report Of Estate Or Inheritance Tax Payment - Resident Or Nonresident

ADVERTISEMENT

Mail To:

Form

401T

Report of Estate or Inheritance Tax Payment

Wisconsin Department of Revenue

Mail Stop 5-144

Resident or Nonresident

PO Box 8906

Madison, WI 53708-8906

Name of Decedent (Last)

(MI)

(First)

Date of Death (MM DD YYYY)

Decedent's Social Security Number

Address of Decedent at Date of Death (Number & Street, Etc.)

Estate Federal ID Number (EIN)

City and State

County of Jurisdiction

Telephone Number of Payor

Name of Attorney or Personal Representative

City

Address

State

Zip Code

For Payor’s Use Only

For Departmental Use Only

.00

Additional Tax

$

.00

.00

Unpaid Balance

$

Advance Payment $

The amount due shown above includes interest of

To be completed by the payor when submitting an advance

payment of Wisconsin estate tax prior to filing Wisconsin

$

.

estate tax return (Form W706) or Wisconsin inheritance

tax prior to filing Wisconsin inheritance tax return (Form

The amount due is payable on or before

101 or Form 101A).

.

THIS FORM DOES NOT TAKE THE PLACE OF AN ESTATE TAX RETURN OR INHERITANCE TAX RETURN.

state tax is due and payable 9 months after the decedent’s

Caution: Returns and documents sent by private carri-

E

death. If the estate tax as finally determined is not paid within

ers must be received by the Department of Revenue on

9 months of the decedent’s death, interest is due. Interest is

or before the due date. See form W706 instructions for

calculated from the date of death to the date the tax is paid

Where to File.

at the rate of 12% per year. Interest is assessed regardless

of any extension to file the return. Any person who fails to

Any payment received will first be credited against penalty

file a return by the due date is subject to a penalty of 5%

and/or interest, if any, and the remainder will be applied

of the tax due but not less than $25 nor more than $500.

to the tax.

The penalty is imposed even if there is no tax due.

If the advance payment exceeds the estate or inheritance

tax as finally determined plus any interest and/or penalty,

Inheritance tax is due and payable at the time of the

decedent’s death. Interest accrues on taxes owing when

the resulting refund will be sent to the payor. No interest

those taxes are not paid within one year after date of death.

will be paid on any refund.

Interest is computed from date of death to the date the

inheritance tax is paid. For deaths on or after May 14, 1972,

the interest rate is 12% per year.

*E1TP09991*

HT-401i (R. 6-09)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1