Land Gains Basic Calculation Foreclosure Property - Vermont Department Of Taxes

ADVERTISEMENT

State of Vermont

Agency of Administration

Department of Taxes

133 State Street

Montpelier, VT 05633-1401

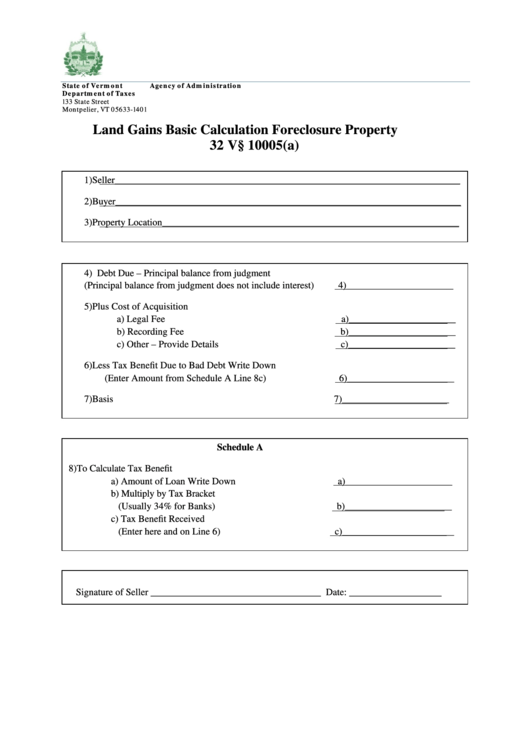

Land Gains Basic Calculation Foreclosure Property

32 V.S.A. § 10005(a)

1) Seller_______________________________________________________________________

2) Buyer_______________________________________________________________________

3) Property Location_____________________________________________________________

4) Debt Due – Principal balance from judgment

(Principal balance from judgment does not include interest)

4)______________________

5) Plus Cost of Acquisition

a) Legal Fee

a)______________________

b) Recording Fee

b)______________________

c) Other – Provide Details

c)______________________

6) Less Tax Benefit Due to Bad Debt Write Down

(Enter Amount from Schedule A Line 8c)

6)______________________

7) Basis

7)______________________

Schedule A

8) To Calculate Tax Benefit

a) Amount of Loan Write Down

a)______________________

b) Multiply by Tax Bracket

(Usually 34% for Banks)

b)______________________

c) Tax Benefit Received

(Enter here and on Line 6)

c)_______________________

Signature of Seller ___________________________________ Date: ___________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2