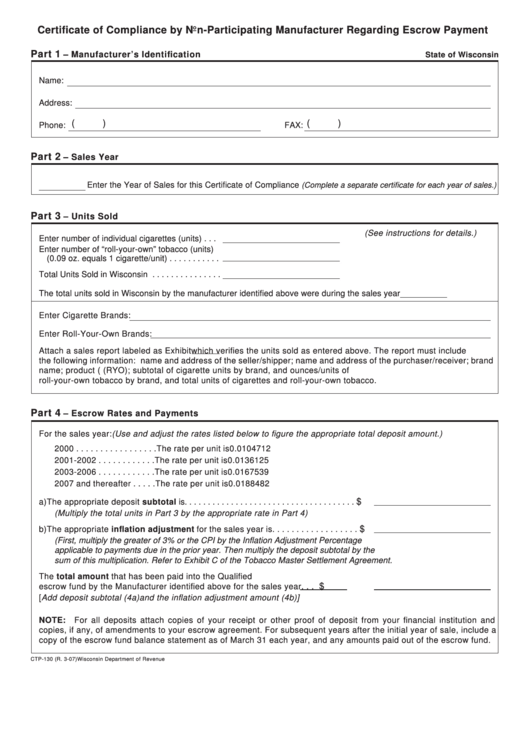

Certificate of Compliance by Non-Participating Manufacturer Regarding Escrow Payment

Part 1

– Manufacturer’s Identification

State of Wisconsin

Name:

Address:

(

)

(

)

Phone:

FAX:

Part 2

– Sales Year

Enter the Year of Sales for this Certificate of Compliance

(Complete a separate certificate for each year of sales.)

Part 3

– Units Sold

(See instructions for details.)

Enter number of individual cigarettes (units) . . .

Enter number of “roll-your-own” tobacco (units)

(0.09 oz. equals 1 cigarette/unit) . . . . . . . . . . .

Total Units Sold in Wisconsin . . . . . . . . . . . . . . .

The total units sold in Wisconsin by the manufacturer identified above were during the sales year

Enter Cigarette Brands:

Enter Roll-Your-Own Brands:

Attach a sales report labeled as Exhibit

which verifies the units sold as entered above. The report must include

the following information: name and address of the seller /shipper; name and address of the purchaser /receiver; brand

name; product (i.e. cigarette or roll-your-own tobacco (RYO); subtotal of cigarette units by brand, and ounces /units of

roll-your-own tobacco by brand, and total units of cigarettes and roll-your-own tobacco.

Part 4

– Escrow Rates and Payments

For the sales year:

(Use and adjust the rates listed below to figure the appropriate total deposit amount.)

2000 . . . . . . . . . . . . . . . . . The rate per unit is

0.0104712

2001-2002 . . . . . . . . . . . . The rate per unit is

0.0136125

2003-2006 . . . . . . . . . . . . The rate per unit is

0.0167539

2007 and thereafter . . . . . The rate per unit is

0.0188482

$

a) The appropriate deposit subtotal is . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Multiply the total units in Part 3 by the appropriate rate in Part 4)

$

b) The appropriate inflation adjustment for the sales year is . . . . . . . . . . . . . . . . . .

(First, multiply the greater of 3% or the CPI by the Inflation Adjustment Percentage

applicable to payments due in the prior year. Then multiply the deposit subtotal by the

sum of this multiplication. Refer to Exhibit C of the Tobacco Master Settlement Agreement.

The total amount that has been paid into the Qualified

$

escrow fund by the Manufacturer identified above for the sales year

. . .

[Add deposit subtotal (4a) and the inflation adjustment amount (4b)]

NOTE: For all deposits attach copies of your receipt or other proof of deposit from your financial institution and

copies, if any, of amendments to your escrow agreement. For subsequent years after the initial year of sale, include a

copy of the escrow fund balance statement as of March 31 each year, and any amounts paid out of the escrow fund.

CTP-130 (R. 3-07)

Wisconsin Department of Revenue

1

1 2

2 3

3