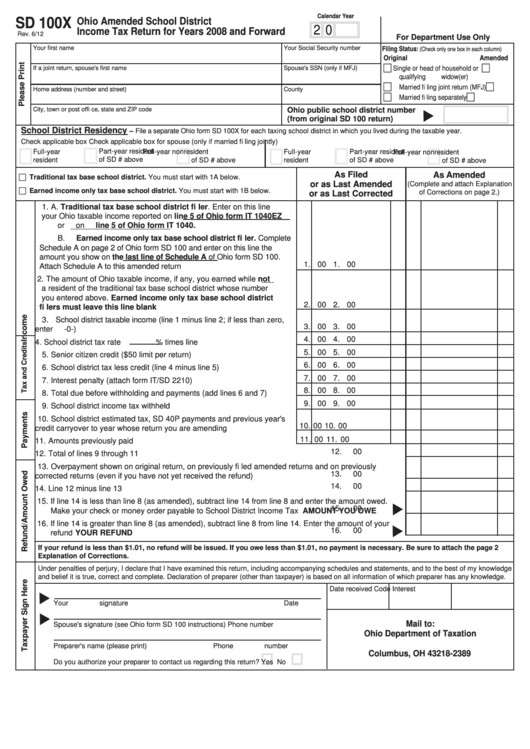

Calendar Year

Reset Form

SD 100X

Ohio Amended School District

2 0

Income Tax Return for Years 2008 and Forward

Rev. 6/12

For Department Use Only

Filing Status:

Your fi rst name

M.I.

Last name

Your Social Security number

(Check only one box in each column)

Original

Amended

If a joint return, spouse's fi rst name

M.I.

Last name

Spouse's SSN (only if MFJ)

Single or head of household or

qualifying widow(er)

Married fi ling joint return (MFJ)

Home address (number and street)

County

Married fi ling separately

City, town or post offi ce, state and ZIP code

Ohio public school district number

(from original SD 100 return)

School District Residency

– File a separate Ohio form SD 100X for each taxing school district in which you lived during the taxable year.

Check applicable box

Check applicable box for spouse (only if married fi ling jointly)

Full-year

Part-year resident

Part-year resident

Full-year nonresident

Full-year

Full-year nonresident

of SD # above

resident

of SD # above

resident

of SD # above

of SD # above

As Filed

As Amended

Traditional tax base school district. You must start with 1A below.

or as Last Amended

(Complete and attach Explanation

Earned income only tax base school district. You must start with 1B below.

of Corrections on page 2.)

or as Last Corrected

1. A. Traditional tax base school district fi ler. Enter on this line

your Ohio taxable income reported on line 5 of Ohio form IT 1040EZ

or on line 5 of Ohio form IT 1040.

B. Earned income only tax base school district fi ler. Complete

Schedule A on page 2 of Ohio form SD 100 and enter on this line the

amount you show on the last line of Schedule A of Ohio form SD 100.

1.

00

1.

00

Attach Schedule A to this amended return ................................................

2. The amount of Ohio taxable income, if any, you earned while not

a resident of the traditional tax base school district whose number

you entered above. Earned income only tax base school district

2.

00

2.

00

fi lers must leave this line blank ...........................................................

3. School district taxable income (line 1 minus line 2; if less than zero,

3.

00

3.

00

enter -0-)..................................................................................................

4.

00

4.

00

4. School district tax rate

% times line 3.......................................

5.

00

5.

00

5. Senior citizen credit ($50 limit per return)................................................

6.

00

6.

00

6. School district tax less credit (line 4 minus line 5) ...................................

7.

00

7.

00

7. Interest penalty (attach form IT/SD 2210) ...............................................

8.

00

8.

00

8. Total due before withholding and payments (add lines 6 and 7) .............

9.

00

9.

00

9. School district income tax withheld .........................................................

10. School district estimated tax, SD 40P payments and previous year's

10.

00 10.

00

credit carryover to year whose return you are amending ........................

11.

00 11.

00

11. Amounts previously paid .........................................................................

12.

00

12. Total of lines 9 through 11 .........................................................................................................................

13. Overpayment shown on original return, on previously fi led amended returns and on previously

13.

00

corrected returns (even if you have not yet received the refund) ..............................................................

14.

00

14. Line 12 minus line 13 ................................................................................................................................

15. If line 14 is less than line 8 (as amended), subtract line 14 from line 8 and enter the amount owed.

15.

00

Make your check or money order payable to School District Income Tax ........ AMOUNT YOU OWE

16. If line 14 is greater than line 8 (as amended), subtract line 8 from line 14. Enter the amount of your

16.

00

refund ...................................................................................................................... YOUR REFUND

If your refund is less than $1.01, no refund will be issued. If you owe less than $1.01, no payment is necessary. Be sure to attach the page 2

Explanation of Corrections.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Date received

Code

Interest

Your signature

Date

Mail to:

Spouse's signature (see Ohio form SD 100 instructions)

Phone number

Ohio Department of Taxation

P.O. Box 182389

Preparer's name (please print)

Phone number

Columbus, OH 43218-2389

Do you authorize your preparer to contact us regarding this return?

Yes

No

1

1 2

2 3

3