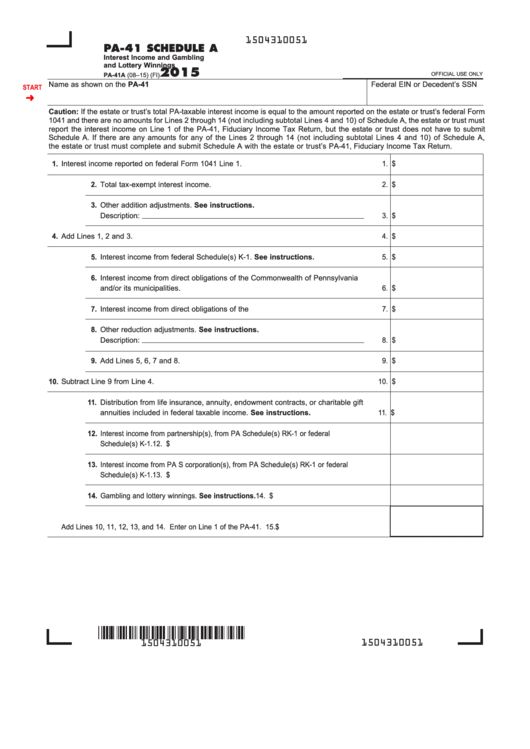

1504310051

PA-41 SCHEDULE A

Interest Income and Gambling

and Lottery Winnings

2015

OFFICIAL USE ONLY

PA-41A (08–15) (FI)

Name as shown on the PA-41

Federal EIN or Decedent’s SSN

START

Caution: If the estate or trust’s total PA-taxable interest income is equal to the amount reported on the estate or trust’s federal Form

1041 and there are no amounts for Lines 2 through 14 (not including subtotal Lines 4 and 10) of Schedule A, the estate or trust must

report the interest income on Line 1 of the PA-41, Fiduciary Income Tax Return, but the estate or trust does not have to submit

Schedule A. If there are any amounts for any of the Lines 2 through 14 (not including subtotal Lines 4 and 10) of Schedule A,

the estate or trust must complete and submit Schedule A with the estate or trust’s PA-41, Fiduciary Income Tax Return.

1. Interest income reported on federal Form 1041 Line 1.

1. $

2. Total tax-exempt interest income.

2. $

3. Other addition adjustments. See instructions.

Description:

3. $

4. Add Lines 1, 2 and 3.

4. $

5. Interest income from federal Schedule(s) K-1. See instructions.

5. $

6. Interest income from direct obligations of the Commonwealth of Pennsylvania

and/or its municipalities.

6. $

7. Interest income from direct obligations of the U.S. government.

7. $

8. Other reduction adjustments. See instructions.

Description:

8. $

9. Add Lines 5, 6, 7 and 8.

9. $

10. Subtract Line 9 from Line 4.

10. $

11. Distribution from life insurance, annuity, endowment contracts, or charitable gift

annuities included in federal taxable income. See instructions.

11. $

12. Interest income from partnership(s), from PA Schedule(s) RK-1 or federal

Schedule(s) K-1.

12. $

13. Interest income from PA S corporation(s), from PA Schedule(s) RK-1 or federal

Schedule(s) K-1.

13. $

14. Gambling and lottery winnings. See instructions.

14. $

15. Total interest income and gambling and lottery winnings

Add Lines 10, 11, 12, 13, and 14. Enter on Line 1 of the PA-41.

15. $

PRINT FORM

Reset Entire Form

1504310051

1504310051

1

1