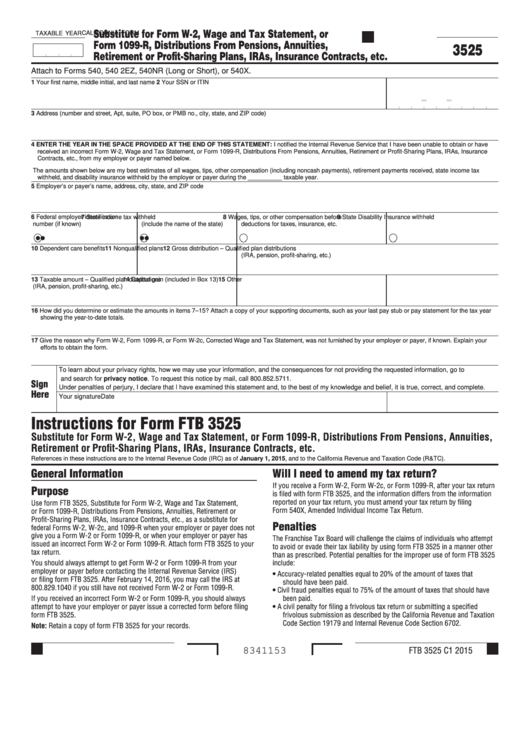

Form 3525 - California Substitute For Form W-2, Wage And Tax Statement, Or Form 1099-R, Distributions From Pensions, Annuities, Retirement Or Profit-Sharing Plans, Iras, Insurance Contracts, Etc.

ADVERTISEMENT

Substitute for Form W-2, Wage and Tax Statement, or

CALIFORNIA FORM

TAXABLE YEAR

Form 1099-R, Distributions From Pensions, Annuities,

3525

Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Attach to Forms 540, 540 2EZ, 540NR (Long or Short), or 540X.

1 Your first name, middle initial, and last name

2 Your SSN or ITIN

3 Address (number and street, Apt, suite, PO box, or PMB no., city, state, and ZIP code)

4 ENTER THE YEAR IN THE SPACE PROVIDED AT THE END OF THIS STATEMENT: I notified the Internal Revenue Service that I have been unable to obtain or have

received an incorrect Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance

Contracts, etc., from my employer or payer named below.

The amounts shown below are my best estimates of all wages, tips, other compensation (including noncash payments), retirement payments received, state income tax

withheld, and disability insurance withheld by the employer or payer during the __________ taxable year.

5 Employer’s or payer’s name, address, city, state, and ZIP code

6 Federal employer identification

7 State income tax withheld

8 Wages, tips, or other compensation before

9 State Disability Insurance withheld

number (if known)

(include the name of the state)

deductions for taxes, insurance, etc.

10 Dependent care benefits

11 Nonqualified plans

12 Gross distribution – Qualified plan distributions

(IRA, pension, profit-sharing, etc.)

13 Taxable amount – Qualified plan distributions

14 Capital gain (included in Box 13)

15 Other

(IRA, pension, profit-sharing, etc.)

16 How did you determine or estimate the amounts in items 7–15? Attach a copy of your supporting documents, such as your last pay stub or pay statement for the tax year

showing the year-to-date totals.

17 Give the reason why Form W-2, Form 1099-R, or Form W-2c, Corrected Wage and Tax Statement, was not furnished by your employer or payer, if known. Explain your

efforts to obtain the form.

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to

ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.852.5711.

Sign

Under penalties of perjury, I declare that I have examined this statement and, to the best of my knowledge and belief, it is true, correct, and complete.

Here

Your signature

Date

Instructions for Form FTB 3525

Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities,

Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

General Information

Will I need to amend my tax return?

If you receive a Form W-2, Form W-2c, or Form 1099-R, after your tax return

Purpose

is filed with form FTB 3525, and the information differs from the information

reported on your tax return, you must amend your tax return by filing

Use form FTB 3525, Substitute for Form W-2, Wage and Tax Statement,

Form 540X, Amended Individual Income Tax Return.

or Form 1099-R, Distributions From Pensions, Annuities, Retirement or

Profit-Sharing Plans, IRAs, Insurance Contracts, etc., as a substitute for

Penalties

federal Forms W-2, W-2c, and 1099-R when your employer or payer does not

give you a Form W-2 or Form 1099-R, or when your employer or payer has

The Franchise Tax Board will challenge the claims of individuals who attempt

issued an incorrect Form W-2 or Form 1099-R. Attach form FTB 3525 to your

to avoid or evade their tax liability by using form FTB 3525 in a manner other

tax return.

than as prescribed. Potential penalties for the improper use of form FTB 3525

You should always attempt to get Form W-2 or Form 1099-R from your

include:

employer or payer before contacting the Internal Revenue Service (IRS)

• Accuracy-related penalties equal to 20% of the amount of taxes that

or filing form FTB 3525. After February 14, 2016, you may call the IRS at

should have been paid.

800.829.1040 if you still have not received Form W-2 or Form 1099-R.

• Civil fraud penalties equal to 75% of the amount of taxes that should have

If you received an incorrect Form W-2 or Form 1099-R, you should always

been paid.

attempt to have your employer or payer issue a corrected form before filing

• A civil penalty for filing a frivolous tax return or submitting a specified

form FTB 3525.

frivolous submission as described by the California Revenue and Taxation

Code Section 19179 and Internal Revenue Code Section 6702.

Note: Retain a copy of form FTB 3525 for your records.

FTB 3525 C1 2015

8341153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1