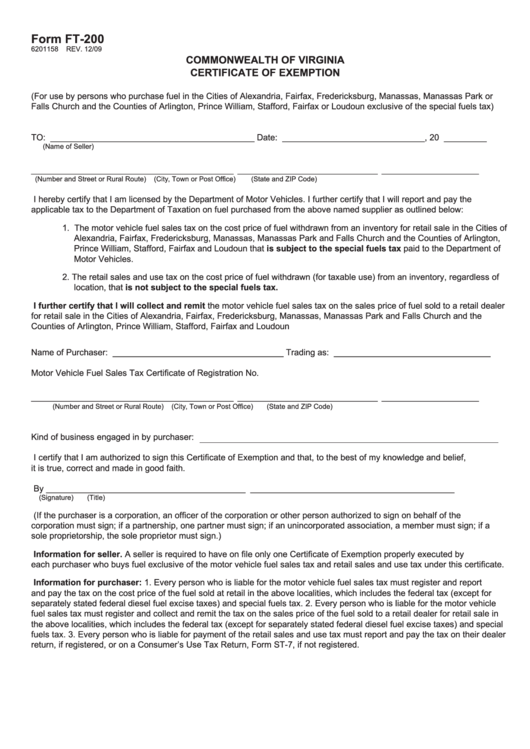

Form FT-200

6201158

REV. 12/09

COMMONWEALTH OF VIRGINIA

CERTIFICATE OF EXEMPTION

(For use by persons who purchase fuel in the Cities of Alexandria, Fairfax, Fredericksburg, Manassas, Manassas Park or

Falls Church and the Counties of Arlington, Prince William, Stafford, Fairfax or Loudoun exclusive of the special fuels tax)

TO: ___________________________________________ Date: ______________________________ , 20 _________

(Name of Seller)

____________________________________________________

____________________________________

_________________________

(Number and Street or Rural Route)

(City, Town or Post Office)

(State and ZIP Code)

I hereby certify that I am licensed by the Department of Motor Vehicles. I further certify that I will report and pay the

applicable tax to the Department of Taxation on fuel purchased from the above named supplier as outlined below:

1. The motor vehicle fuel sales tax on the cost price of fuel withdrawn from an inventory for retail sale in the Cities of

Alexandria, Fairfax, Fredericksburg, Manassas, Manassas Park and Falls Church and the Counties of Arlington,

Prince William, Stafford, Fairfax and Loudoun that is subject to the special fuels tax paid to the Department of

Motor Vehicles.

2. The retail sales and use tax on the cost price of fuel withdrawn (for taxable use) from an inventory, regardless of

location, that is not subject to the special fuels tax.

I further certify that I will collect and remit the motor vehicle fuel sales tax on the sales price of fuel sold to a retail dealer

for retail sale in the Cities of Alexandria, Fairfax, Fredericksburg, Manassas, Manassas Park and Falls Church and the

Counties of Arlington, Prince William, Stafford, Fairfax and Loudoun

Name of Purchaser: ____________________________________ Trading as: _________________________________

Motor Vehicle Fuel Sales Tax Certificate of Registration No.

____________________________________________________

____________________________________

_________________________

(Number and Street or Rural Route)

(City, Town or Post Office)

(State and ZIP Code)

Kind of business engaged in by purchaser:

I certify that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief,

it is true, correct and made in good faith.

By __________________________________________

___________________________________________

(Signature)

(Title)

(If the purchaser is a corporation, an officer of the corporation or other person authorized to sign on behalf of the

corporation must sign; if a partnership, one partner must sign; if an unincorporated association, a member must sign; if a

sole proprietorship, the sole proprietor must sign.)

Information for seller. A seller is required to have on file only one Certificate of Exemption properly executed by

each purchaser who buys fuel exclusive of the motor vehicle fuel sales tax and retail sales and use tax under this certificate.

Information for purchaser: 1. Every person who is liable for the motor vehicle fuel sales tax must register and report

and pay the tax on the cost price of the fuel sold at retail in the above localities, which includes the federal tax (except for

separately stated federal diesel fuel excise taxes) and special fuels tax. 2. Every person who is liable for the motor vehicle

fuel sales tax must register and collect and remit the tax on the sales price of the fuel sold to a retail dealer for retail sale in

the above localities, which includes the federal tax (except for separately stated federal diesel fuel excise taxes) and special

fuels tax. 3. Every person who is liable for payment of the retail sales and use tax must report and pay the tax on their dealer

return, if registered, or on a Consumer’s Use Tax Return, Form ST-7, if not registered.

1

1