Form Ct-2 - Guidelines And Rules For The Virginia Communications Taxes

ADVERTISEMENT

CT-2

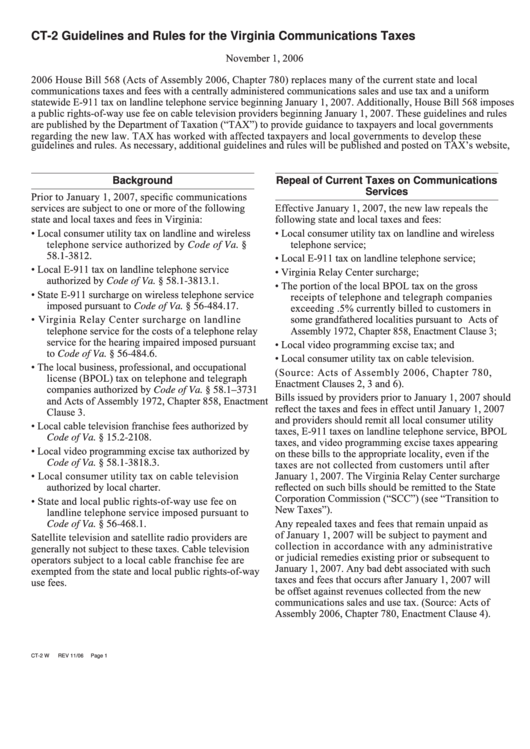

Guidelines and Rules for the Virginia Communications Taxes

November 1, 2006

2006 House Bill 568 (Acts of Assembly 2006, Chapter 780) replaces many of the current state and local

communications taxes and fees with a centrally administered communications sales and use tax and a uniform

statewide E-911 tax on landline telephone service beginning January 1, 2007. Additionally, House Bill 568 imposes

a public rights-of-way use fee on cable television providers beginning January 1, 2007. These guidelines and rules

are published by the Department of Taxation (“TAX”) to provide guidance to taxpayers and local governments

regarding the new law. TAX has worked with affected taxpayers and local governments to develop these

guidelines and rules. As necessary, additional guidelines and rules will be published and posted on TAX’s website,

Background

Repeal of Current Taxes on Communications

Services

Prior to January 1, 2007, specific communications

services are subject to one or more of the following

Effective January 1, 2007, the new law repeals the

state and local taxes and fees in Virginia:

following state and local taxes and fees:

•

Local consumer utility tax on landline and wireless

•

Local consumer utility tax on landline and wireless

telephone service authorized by Code of Va. §

telephone service;

•

Local E-911 tax on landline telephone service;

58.1‑3812.

•

Local E-911 tax on landline telephone service

•

Virginia Relay Center surcharge;

authorized by Code of Va. § 58.1‑3813.1.

•

The portion of the local BPOL tax on the gross

•

State E-911 surcharge on wireless telephone service

receipts of telephone and telegraph companies

imposed pursuant to Code of Va. § 56‑484.17.

exceeding .5% currently billed to customers in

•

Virginia Relay Center surcharge on landline

some grandfathered localities pursuant to Acts of

telephone service for the costs of a telephone relay

Assembly 1972, Chapter 858, Enactment Clause 3;

service for the hearing impaired imposed pursuant

•

Local video programming excise tax; and

to Code of Va. § 56‑484.6.

•

Local consumer utility tax on cable television.

•

The local business, professional, and occupational

(Source: Acts of Assembly 2006, Chapter 780,

license (BPOL) tax on telephone and telegraph

Enactment Clauses 2, 3 and 6).

companies authorized by Code of Va. § 58.1–3731

Bills issued by providers prior to January 1, 2007 should

and Acts of Assembly 1972, Chapter 858, Enactment

reflect the taxes and fees in effect until January 1, 2007

Clause 3.

and providers should remit all local consumer utility

•

Local cable television franchise fees authorized by

taxes, E-911 taxes on landline telephone service, BPOL

Code of Va. § 15.2‑2108.

taxes, and video programming excise taxes appearing

•

Local video programming excise tax authorized by

on these bills to the appropriate locality, even if the

taxes are not collected from customers until after

Code of Va. § 58.1‑3818.3.

•

Local consumer utility tax on cable television

January 1, 2007. The Virginia Relay Center surcharge

authorized by local charter.

reflected on such bills should be remitted to the State

Corporation Commission (“SCC”) (see “Transition to

•

State and local public rights-of-way use fee on

New Taxes”).

landline telephone service imposed pursuant to

Any repealed taxes and fees that remain unpaid as

Code of Va. § 56‑468.1.

of January 1, 2007 will be subject to payment and

Satellite television and satellite radio providers are

collection in accordance with any administrative

generally not subject to these taxes. Cable television

or judicial remedies existing prior or subsequent to

operators subject to a local cable franchise fee are

January 1, 2007. Any bad debt associated with such

exempted from the state and local public rights-of-way

taxes and fees that occurs after January 1, 2007 will

use fees.

be offset against revenues collected from the new

communications sales and use tax. (Source: Acts of

Assembly 2006, Chapter 780, Enactment Clause 4).

CT-2 W

REV 11/06

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16