Form Ft-102b - Virginia Motor Vehicle Fuel Sales Tax Schedule Of Retailer Purchases For Resale

ADVERTISEMENT

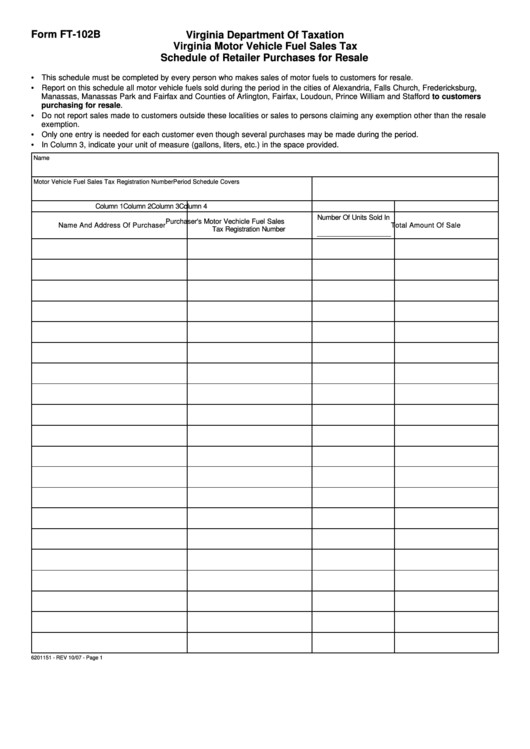

Form FT-102B

Virginia Department Of Taxation

Virginia Motor Vehicle Fuel Sales Tax

Schedule of Retailer Purchases for Resale

• This schedule must be completed by every person who makes sales of motor fuels to customers for resale.

• Report on this schedule all motor vehicle fuels sold during the period in the cities of Alexandria, Falls Church, Fredericksburg,

Manassas, Manassas Park and Fairfax and Counties of Arlington, Fairfax, Loudoun, Prince William and Stafford to customers

purchasing for resale.

• Do not report sales made to customers outside these localities or sales to persons claiming any exemption other than the resale

exemption.

• Only one entry is needed for each customer even though several purchases may be made during the period.

• In Column 3, indicate your unit of measure (gallons, liters, etc.) in the space provided.

Name

Motor Vehicle Fuel Sales Tax Registration Number

Period Schedule Covers

Column 1

Column 2

Column 3

Column 4

Number Of Units Sold In

Purchaser's Motor Vechicle Fuel Sales

Name And Address Of Purchaser

Total Amount Of Sale

Tax Registration Number

___________________

6201151 - REV 10/07 - Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2