Reset Form Button

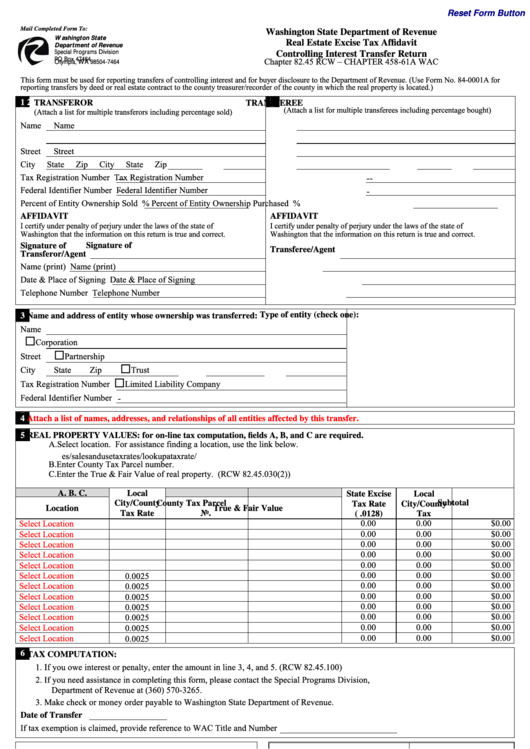

Mail Completed Form To:

Washington State Department of Revenue

Washington State

Real Estate Excise Tax Affidavit

Department of Revenue

Special Programs Division

Controlling Interest Transfer Return

PO Box 47464

Chapter 82.45 RCW – CHAPTER 458-61A WAC

Olympia, WA 98504-7464

This form must be used for reporting transfers of controlling interest and for buyer disclosure to the Department of Revenue. (Use Form No. 84-0001A for

reporting transfers by deed or real estate contract to the county treasurer/recorder of the county in which the real property is located.)

1

2

TRANSFEROR

TRANSFEREE

(Attach a list for multiple transferors including percentage sold)

(Attach a list for multiple transferees including percentage bought)

Name

Name

Street

Street

City

State

Zip

City

State

Zip

Tax Registration Number

Tax Registration Number

--

--

Federal Identifier Number

Federal Identifier Number

-

-

Percent of Entity Ownership Sold

%

Percent of Entity Ownership Purchased

%

AFFIDAVIT

AFFIDAVIT

I certify under penalty of perjury under the laws of the state of

I certify under penalty of perjury under the laws of the state of

Washington that the information on this return is true and correct.

Washington that the information on this return is true and correct.

Signature of

Signature of

Transferor/Agent

Transferee/Agent

Name (print)

Name (print)

Date & Place of Signing

Date & Place of Signing

Telephone Number

Telephone Number

Type of entity (check one):

3

Name and address of entity whose ownership was transferred:

Name

Corporation

Street

Partnership

City

State

Zip

Trust

Tax Registration Number

Limited Liability Company

Federal Identifier Number

-

4

Attach a list of names, addresses, and relationships of all entities affected by this transfer.

5

REAL PROPERTY VALUES: for on-line tax computation, fields A, B, and C are required.

A. Select location. For assistance finding a location, use the link below.

B. Enter County Tax Parcel number.

C. Enter the True & Fair Value of real property. (RCW 82.45.030(2))

A.

B.

C.

Local

State Excise

Local

City/County

County Tax Parcel

Subtotal

Tax Rate

City/County

Location

True & Fair Value

Tax Rate

No.

( .0128)

Tax

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

Select Location

0.00

0.00

$0.00

6

TAX COMPUTATION:

1.

If you owe interest or penalty, enter the amount in line 3, 4, and 5. (RCW 82.45.100)

2.

If you need assistance in completing this form, please contact the Special Programs Division,

Department of Revenue at (360) 570-3265.

3.

Make check or money order payable to Washington State Department of Revenue.

Date of Transfer

If tax exemption is claimed, provide reference to WAC Title and Number

$

1. State Tax ........................................

$0.00

Department of Revenue Use Only

$

2. Local Tax .......................................

$0.00

$

3. State Delinquent Interest................

$

4. Local Delinquent Interest...............

$

5. State & Local Delinquent Penalty..

$

TOTAL DUE

$0.00

Please See Information On Reverse

PLEASE NOTE: This completed document cannot be saved to your hard drive

REV 84 0001Be (6/28/12)

without the full version of Adobe Acrobat. If you are not using the full version of

Print Form Button

Adobe Acrobat, you must complete this form, then print.

1

1 2

2