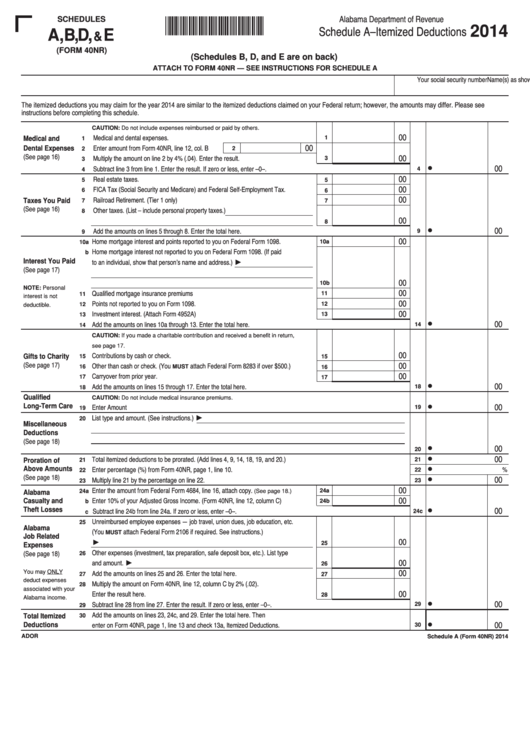

Schedule A (Form 40nr) - Alabama Itemized Deductions - 2014

ADVERTISEMENT

Alabama Department of Revenue

Schedule A–Itemized Deductions

SCHEDULES

1400034N

2014

A,B,D,

E

&

(FORM 40NR)

(Schedules B, D, and E are on back)

ATTACH TO FORM 40NR — SEE INSTRUCTIONS FOR SCHEDULE A

Name(s) as shown on Form 40NR

Your social security number

The itemized deductions you may claim for the year 2014 are similar to the itemized deductions claimed on your Federal return; however, the amounts may differ. Please see

instructions before completing this schedule.

00

CAUTION: Do not include expenses reimbursed or paid by others.

1 Medical and dental expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

1

Medical and

2 Enter amount from Form 40NR, line 12, col. B . . . .

Dental Expenses

00

2

(See page 16)

3 Multiply the amount on line 2 by 4% (.04). Enter the result. . . . . . . . . . . . . . . . . . . . . . . . .

00

3

4 Subtract line 3 from line 1. Enter the result. If zero or less, enter –0–.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

4

5 Real estate taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

5

6 FICA Tax (Social Security and Medicare) and Federal Self-Employment Tax.. . . . . . . . . .

00

6

7 Railroad Retirement. (Tier 1 only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxes You Paid

7

(See page 16)

8 Other taxes. (List – include personal property taxes.)

00

00

8

9 Add the amounts on lines 5 through 8. Enter the total here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

9

10a Home mortgage interest and points reported to you on Federal Form 1098. . . . . . . . . . . .

10a

b Home mortgage interest not reported to you on Federal Form 1098. (If paid

to an individual, show that person’s name and address.)

Interest You Paid

(See page 17)

00

00

10b

11 Qualified mortgage insurance premiums. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: Personal

00

11

12 Points not reported to you on Form 1098. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

interest is not

00

12

deductible.

13 Investment interest. (Attach Form 4952A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

13

14 Add the amounts on lines 10a through 13. Enter the total here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

14

CAUTION: If you made a charitable contribution and received a benefit in return,

00

see page 17.

15 Contributions by cash or check. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

Gifts to Charity

(See page 17)

15

16 Other than cash or check. (You MUST attach Federal Form 8283 if over $500.) . . . . . . . .

00

16

17 Carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

17

18 Add the amounts on lines 15 through 17. Enter the total here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

18

00

Qualified

CAUTION: Do not include medical insurance premiums.

19 Enter Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Long-Term Care

•

19

20 List type and amount. (See instructions.)

Miscellaneous

Deductions

(See page 18)

00

•

00

20

21 Total itemized deductions to be prorated. (Add lines 4, 9, 14, 18, 19, and 20.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

Proration of

21

22 Enter percentage (%) from Form 40NR, page 1, line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

Above Amounts

•

00

(See page 18)

22

23 Multiply line 21 by the percentage on line 22. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

23

24a Enter the amount from Federal Form 4684, line 16, attach copy. (See page 18.). . . . . . . .

00

24a

Alabama

b Enter 10% of your Adjusted Gross Income. (Form 40NR, line 12, column C). . . . . . . . . . .

Casualty and

00

24b

c Subtract line 24b from line 24a. If zero or less, enter –0–. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Theft Losses

•

24c

25 Unreimbursed employee expenses — job travel, union dues, job education, etc.

(You MUST attach Federal Form 2106 if required. See instructions.)

Alabama

00

Job Related

25

Expenses

26 Other expenses (investment, tax preparation, safe deposit box, etc.). List type

(See page 18)

00

and amount.

00

26

27 Add the amounts on lines 25 and 26. Enter the total here. . . . . . . . . . . . . . . . . . . . . . . . . .

You may ONLY

27

28 Multiply the amount on Form 40NR, line 12, column C by 2% (.02).

deduct expenses

00

Enter the result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

associated with your

00

28

29 Subtract line 28 from line 27. Enter the result. If zero or less, enter –0–.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Alabama income.

•

29

30 Add the amounts on lines 23, 24c, and 29. Enter the total here. Then

00

Total Itemized

enter on Form 40NR, page 1, line 13 and check 13a, Itemized Deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

Deductions

30

ADOR

Schedule A (Form 40NR) 2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2