Authorization Instructions And Agreement For Electronic Funds Transfer (Eft) Cigarette Tax Stamps

ADVERTISEMENT

Reset This Form

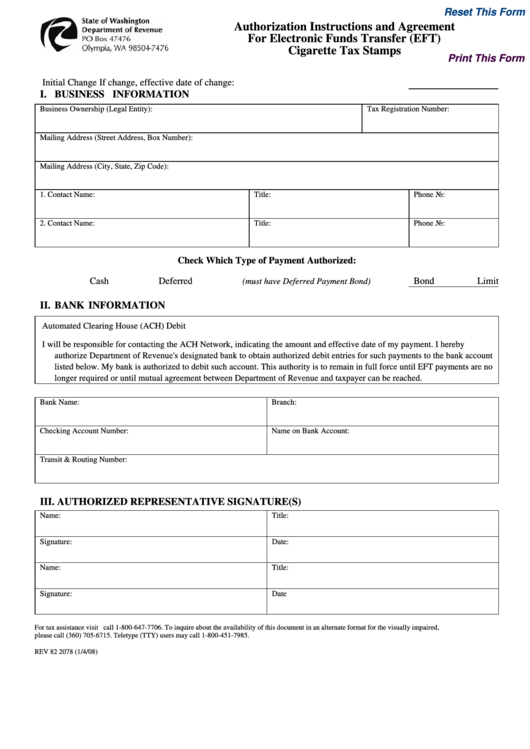

Authorization Instructions and Agreement

For Electronic Funds Transfer (EFT)

Cigarette Tax Stamps

Print This Form

Initial

Change

If change, effective date of change:

I. BUSINESS INFORMATION

Business Ownership (Legal Entity):

Tax Registration Number:

Mailing Address (Street Address, Box Number):

Mailing Address (City, State, Zip Code):

1. Contact Name:

Title:

Phone No:

2. Contact Name:

Title:

Phone No:

Check Which Type of Payment Authorized:

Cash

Deferred

Bond Limit

(must have Deferred Payment Bond)

II. BANK INFORMATION

Automated Clearing House (ACH) Debit

I will be responsible for contacting the ACH Network, indicating the amount and effective date of my payment. I hereby

authorize Department of Revenue's designated bank to obtain authorized debit entries for such payments to the bank account

listed below. My bank is authorized to debit such account. This authority is to remain in full force until EFT payments are no

longer required or until mutual agreement between Department of Revenue and taxpayer can be reached.

Bank Name:

Branch:

Checking Account Number:

Name on Bank Account:

Transit & Routing Number:

III. AUTHORIZED REPRESENTATIVE SIGNATURE(S)

Name:

Title:

Signature:

Date:

Name:

Title:

Signature:

Date

For tax assistance visit or call 1-800-647-7706. To inquire about the availability of this document in an alternate format for the visually impaired,

please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

REV 82 2078 (1/4/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1