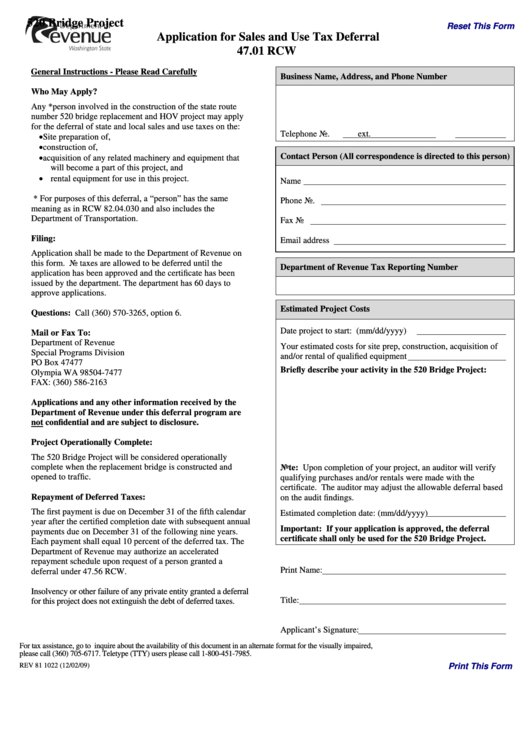

520 Bridge Project

Reset This Form

Application for Sales and Use Tax Deferral

47.01 RCW

General Instructions - Please Read Carefully

Business Name, Address, and Phone Number

Who May Apply?

Any *person involved in the construction of the state route

number 520 bridge replacement and HOV project may apply

for the deferral of state and local sales and use taxes on the:

Telephone No.

ext.

• Site preparation of,

• construction of,

• acquisition of any related machinery and equipment that

Contact Person (All correspondence is directed to this person)

will become a part of this project, and

• rental equipment for use in this project.

Name

* For purposes of this deferral, a “person” has the same

Phone No.

meaning as in RCW 82.04.030 and also includes the

Department of Transportation.

Fax No

Filing:

Email address

Application shall be made to the Department of Revenue on

this form. No taxes are allowed to be deferred until the

Department of Revenue Tax Reporting Number

application has been approved and the certificate has been

issued by the department. The department has 60 days to

approve applications.

Estimated Project Costs

Questions: Call (360) 570-3265, option 6.

Date project to start: (mm/dd/yyyy)

Mail or Fax To:

Department of Revenue

Your estimated costs for site prep, construction, acquisition of

Special Programs Division

and/or rental of qualified equipment

PO Box 47477

Briefly describe your activity in the 520 Bridge Project:

Olympia WA 98504-7477

FAX: (360) 586-2163

Applications and any other information received by the

Department of Revenue under this deferral program are

not confidential and are subject to disclosure.

Project Operationally Complete:

The 520 Bridge Project will be considered operationally

complete when the replacement bridge is constructed and

Note: Upon completion of your project, an auditor will verify

opened to traffic.

qualifying purchases and/or rentals were made with the

certificate. The auditor may adjust the allowable deferral based

Repayment of Deferred Taxes:

on the audit findings.

The first payment is due on December 31 of the fifth calendar

Estimated completion date: (mm/dd/yyyy)

year after the certified completion date with subsequent annual

Important: If your application is approved, the deferral

payments due on December 31 of the following nine years.

certificate shall only be used for the 520 Bridge Project.

Each payment shall equal 10 percent of the deferred tax. The

Department of Revenue may authorize an accelerated

repayment schedule upon request of a person granted a

Print Name:

deferral under 47.56 RCW.

Insolvency or other failure of any private entity granted a deferral

Title:

for this project does not extinguish the debt of deferred taxes.

Applicant’s Signature:

For tax assistance, go to dor.wa.gov or call 1-800-647-7706. To inquire about the availability of this document in an alternate format for the visually impaired,

please call (360) 705-6717. Teletype (TTY) users please call 1-800-451-7985.

REV 81 1022 (12/02/09)

Print This Form

1

1