Reset This Form

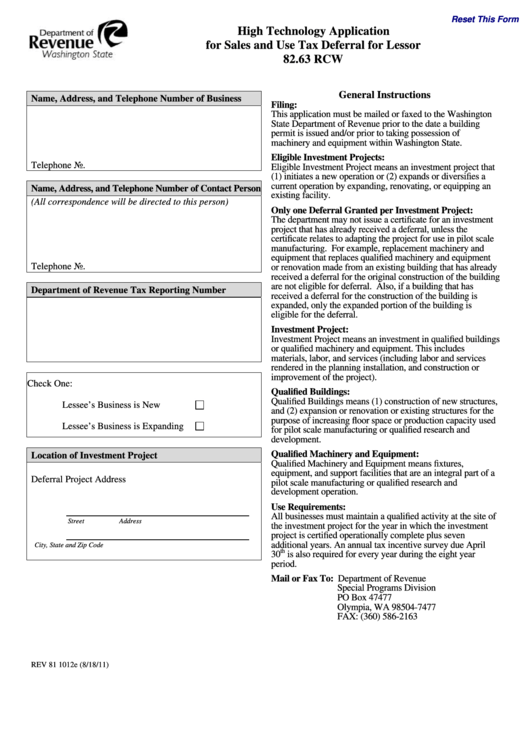

High Technology Application

for Sales and Use Tax Deferral for Lessor

82.63 RCW

General Instructions

Name, Address, and Telephone Number of Business

Filing:

This application must be mailed or faxed to the Washington

State Department of Revenue prior to the date a building

permit is issued and/or prior to taking possession of

machinery and equipment within Washington State.

Eligible Investment Projects:

Telephone No.

Eligible Investment Project means an investment project that

(1) initiates a new operation or (2) expands or diversifies a

current operation by expanding, renovating, or equipping an

Name, Address, and Telephone Number of Contact Person

existing facility.

(All correspondence will be directed to this person)

Only one Deferral Granted per Investment Project:

The department may not issue a certificate for an investment

project that has already received a deferral, unless the

certificate relates to adapting the project for use in pilot scale

manufacturing. For example, replacement machinery and

equipment that replaces qualified machinery and equipment

Telephone No.

or renovation made from an existing building that has already

received a deferral for the original construction of the building

are not eligible for deferral. Also, if a building that has

Department of Revenue Tax Reporting Number

received a deferral for the construction of the building is

expanded, only the expanded portion of the building is

eligible for the deferral.

Investment Project:

Investment Project means an investment in qualified buildings

or qualified machinery and equipment. This includes

materials, labor, and services (including labor and services

rendered in the planning installation, and construction or

improvement of the project).

Check One:

Qualified Buildings:

Qualified Buildings means (1) construction of new structures,

Lessee’s Business is New

and (2) expansion or renovation or existing structures for the

purpose of increasing floor space or production capacity used

Lessee’s Business is Expanding

for pilot scale manufacturing or qualified research and

development.

Qualified Machinery and Equipment:

Location of Investment Project

Qualified Machinery and Equipment means fixtures,

equipment, and support facilities that are an integral part of a

Deferral Project Address

pilot scale manufacturing or qualified research and

development operation.

Use Requirements:

All businesses must maintain a qualified activity at the site of

Street Address

the investment project for the year in which the investment

project is certified operationally complete plus seven

additional years. An annual tax incentive survey due April

City, State and Zip Code

th

30

is also required for every year during the eight year

period.

Mail or Fax To: Department of Revenue

Special Programs Division

PO Box 47477

Olympia, WA 98504-7477

FAX: (360) 586-2163

REV 81 1012e (8/18/11)

1

1 2

2 3

3