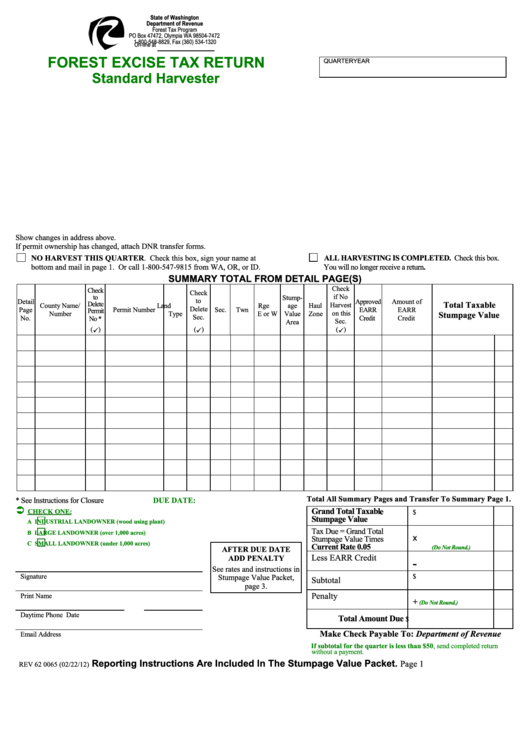

Forest Excise Tax Return

ADVERTISEMENT

State of Washington

Department of Revenue

Forest Tax Program

PO Box 47472, Olympia WA 98504-7472

1-800-548-8829, Fax (360) 534-1320

On-line at

FOREST EXCISE TAX RETURN

QUARTER

YEAR

Standard Harvester

Show changes in address above.

If permit ownership has changed, attach DNR transfer forms.

NO HARVEST THIS QUARTER. Check this box, sign your name at

ALL HARVESTING IS COMPLETED. Check this box.

bottom and mail in page 1. Or call 1-800-547-9815 from WA, OR, or ID.

You will no longer receive a return.

SUMMARY TOTAL FROM DETAIL PAGE(S)

Check

Check

Check

to

if No

Stump-

to

Detail

Approved

Amount of

Delete

Total Taxable

Harvest

County Name/

Land

Rge

age

Haul

Delete

Page

Permit Number

Sec.

Twn

EARR

EARR

Permit

on this

Number

Type

E or W

Value

Zone

Stumpage Value

Sec.

No.

Credit

Credit

No *

Sec.

Area

( )

( )

( )

* See Instructions for Closure

DUE DATE:

Total All Summary Pages and Transfer To Summary Page 1.

Grand Total Taxable

CHECK ONE:

$

Stumpage Value

A

INDUSTRIAL LANDOWNER (wood using plant)

Tax Due = Grand Total

B

LARGE LANDOWNER (over 1,000 acres)

x

Stumpage Value Times

C

SMALL LANDOWNER (under 1,000 acres)

Current Rate 0.05

(Do Not Round.)

AFTER DUE DATE

ADD PENALTY

Less EARR Credit

-

See rates and instructions in

Signature

$

Stumpage Value Packet,

Subtotal

page 3.

Print Name

Penalty

+

(Do Not Round.)

Daytime Phone

Date

Total Amount Due

$

Make Check Payable To: Department of Revenue

Email Address

If subtotal for the quarter is less than $50, send completed return

without a payment.

Reporting Instructions Are Included In The Stumpage Value Packet.

Page 1

REV 62 0065

(02/22/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2