Form Pt-200 - Quarterly Petroleum Business Tax Return

ADVERTISEMENT

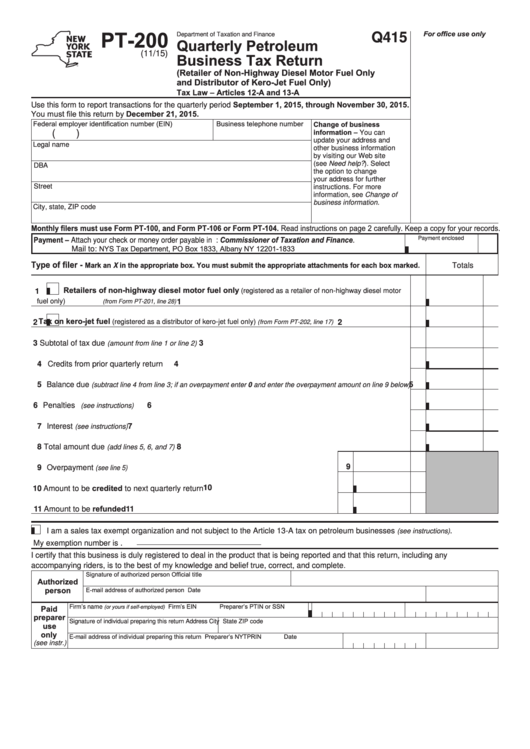

PT-200

For office use only

Department of Taxation and Finance

Q415

Quarterly Petroleum

(11/15)

Business Tax Return

(Retailer of Non-Highway Diesel Motor Fuel Only

and Distributor of Kero-Jet Fuel Only)

Tax Law – Articles 12-A and 13-A

Use this form to report transactions for the quarterly period September 1, 2015, through November 30, 2015.

You must file this return by December 21, 2015.

Federal employer identification number (EIN)

Business telephone number

Change of business

information – You can

(

)

update your address and

Legal name

other business information

by visiting our Web site

(see Need help?). Select

DBA

the option to change

your address for further

Street

instructions. For more

information, see Change of

business information.

City, state, ZIP code

Monthly filers must use Form PT-100, and Form PT-106 or Form PT-104. Read instructions on page 2 carefully. Keep a copy for your records.

Payment – Attach your check or money order payable in U.S. funds to: Commissioner of Taxation and Finance.

Payment enclosed

NYS Tax Department, PO Box 1833, Albany NY 12201-1833

Mail to:

Type of filer -

Mark an X in the appropriate box. You must submit the appropriate attachments for each box marked.

Totals

Retailers of non-highway diesel motor fuel only

(registered as a retailer of non-highway diesel motor

1

fuel only)

...........................................................................................................

1

(from Form PT-201, line 28)

Tax on kero-jet fuel

(registered as a distributor of kero-jet fuel only)

2

2

(from Form PT-202, line 17)

.........................

3 Subtotal of tax due

..............................................................................................

3

(amount from line 1 or line 2)

4 Credits from prior quarterly return .................................................................................................................

4

5 Balance due

5

(subtract line 4 from line 3; if an overpayment enter 0 and enter the overpayment amount on line 9 below)

6 Penalties

..............................................................................................................................

6

(see instructions)

7 Interest

.................................................................................................................................

7

(see instructions)

8 Total amount due

..........................................................................................................

8

(add lines 5, 6, and 7)

9

9 Overpayment

.....................................................................................................

(see line 5)

10 Amount to be credited to next quarterly return ........................................................... 10

11 Amount to be refunded............................................................................................... 11

I am a sales tax exempt organization and not subject to the Article 13-A tax on petroleum businesses

.

(see instructions)

My exemption number is

.

I certify that this business is duly registered to deal in the product that is being reported and that this return, including any

accompanying riders, is to the best of my knowledge and belief true, correct, and complete.

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Date

Firm’s EIN

Preparer’s PTIN or SSN

Paid

Firm’s name

(or yours if self-employed)

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2