Form Pt-350 - Petroleum Business Tax Return For Fuel Consumption - Commercial Vessels - 2015

ADVERTISEMENT

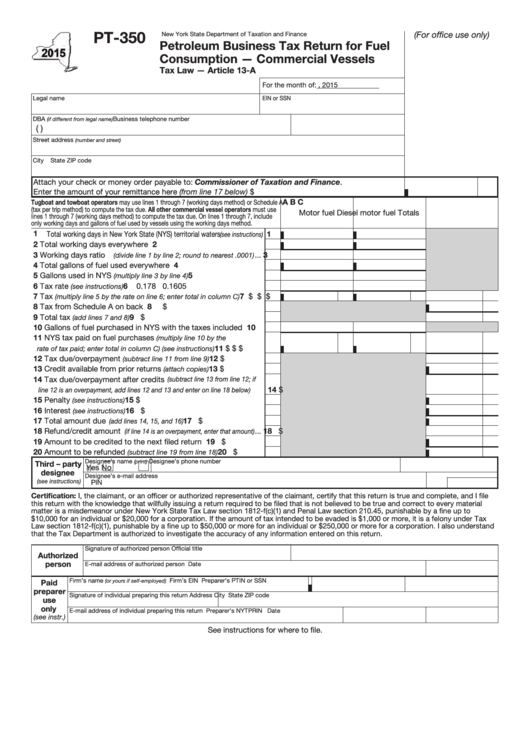

PT-350

(For office use only)

New York State Department of Taxation and Finance

Petroleum Business Tax Return for Fuel

Consumption — Commercial Vessels

Tax Law — Article 13-A

For the month of:

, 2015

Legal name

EIN or SSN

DBA

Business telephone number

(if different from legal name)

(

)

Street address

(number and street)

City

State

ZIP code

Attach your check or money order payable to: Commissioner of Taxation and Finance.

Enter the amount of your remittance here (from line 17 below) .......................................................................

$

A

B

C

Tugboat and towboat operators may use lines 1 through 7 (working days method) or Schedule A

(tax per trip method) to compute the tax due. All other commercial vessel operators must use

Motor fuel

Diesel motor fuel

Totals

lines 1 through 7 (working days method) to compute the tax due. On lines 1 through 7, include

only working days and gallons of fuel used by vessels using the working days method.

1 Total working days in New York State (NYS) territorial waters

1

(see instructions)

2 Total working days everywhere .................................................

2

3 Working days ratio

3

...

(divide line 1 by line 2; round to nearest .0001)

4 Total gallons of fuel used everywhere .......................................

4

5 Gallons used in NYS

..............................

5

(multiply line 3 by line 4)

6 Tax rate

6

.............................................................

0.178

0.1605

(see instructions)

7 Tax

.......

7

$

$

$

(multiply line 5 by the rate on line 6; enter total in column C)

8 Tax from Schedule A on back ...................................................

8

$

9 Total tax

..........................................................

9

$

(add lines 7 and 8)

10 Gallons of fuel purchased in NYS with the taxes included ....... 10

11 NYS tax paid on fuel purchases

(multiply line 10 by the

.............. 11

$

$

$

rate of tax paid; enter total in column C) (see instructions)

12 Tax due/overpayment

....................... 12

$

(subtract line 11 from line 9)

13 Credit available from prior returns

....................... 13

$

(attach copies)

14 Tax due/overpayment after credits

(subtract line 13 from line 12; if

14

$

line 12 is an overpayment, add lines 12 and 13 and enter on line 18 below)

15 Penalty

............................................................. 15

$

(see instructions)

16 Interest

............................................................. 16

$

(see instructions)

17 Total amount due

................................... 17

$

(add lines 14, 15, and 16)

18 Refund/credit amount

... 18

$

(if line 14 is an overpayment, enter that amount)

19 Amount to be credited to the next filed return .......................... 19

$

20 Amount to be refunded

................... 20

$

(subtract line 19 from line 18)

Designee’s name

Designee’s phone number

(print)

Third – party

Yes

No

(

)

designee

Designee’s e-mail address

(see instructions)

PIN

Certification: I, the claimant, or an officer or authorized representative of the claimant, certify that this return is true and complete, and I file

this return with the knowledge that willfully issuing a return required to be filed that is not believed to be true and correct to every material

matter is a misdemeanor under New York State Tax Law section 1812-f(c)(1) and Penal Law section 210.45, punishable by a fine up to

$10,000 for an individual or $20,000 for a corporation. If the amount of tax intended to be evaded is $1,000 or more, it is a felony under Tax

Law section 1812-f(c)(1), punishable by a fine up to $50,000 or more for an individual or $250,000 or more for a corporation. I also understand

that the Tax Department is authorized to investigate the accuracy of any information entered on this return.

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Date

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2