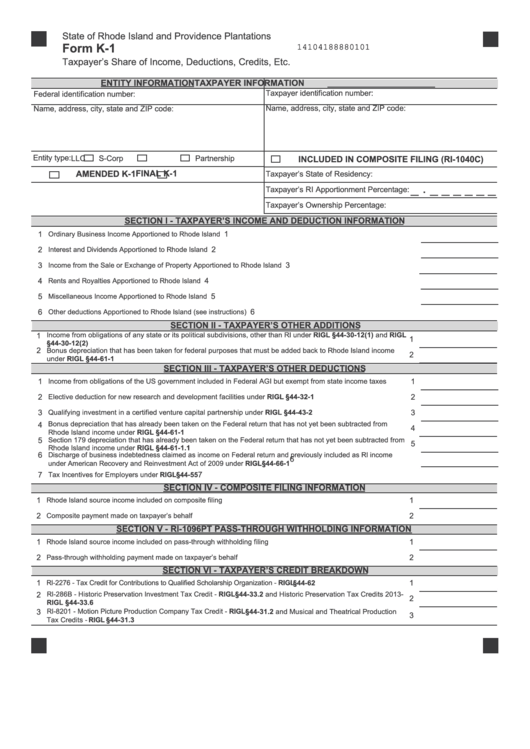

Form K-1 - Taxpayer'S Share Of Income, Deductions, Credits, Etc.

ADVERTISEMENT

State of Rhode Island and Providence Plantations

Form K-1

14104188880101

Taxpayer’s Share of Income, Deductions, Credits, Etc.

ENTITY INFORMATION

TAXPAYER INFORMATION

Taxpayer identification number:

Federal identification number:

Name, address, city, state and ZIP code:

Name, address, city, state and ZIP code:

Entity type:

S-Corp

LLC

Partnership

INCLUDED IN COMPOSITE FILING (RI-1040C)

AMENDED K-1

FINAL K-1

Taxpayer’s State of Residency:

_ . _ _ _ _ _ _

Taxpayer’s RI Apportionment Percentage:

Taxpayer’s Ownership Percentage:

SECTION I - TAXPAYER’S INCOME AND DEDUCTION INFORMATION

1

Ordinary Business Income Apportioned to Rhode Island ...............................................................................................

1

2

Interest and Dividends Apportioned to Rhode Island ......................................................................................................

2

3

3

Income from the Sale or Exchange of Property Apportioned to Rhode Island ...............................................................

4

Rents and Royalties Apportioned to Rhode Island .........................................................................................................

4

5

5

Miscellaneous Income Apportioned to Rhode Island ......................................................................................................

6

6

Other deductions Apportioned to Rhode Island (see instructions) ..................................................................................

SECTION II - TAXPAYER’S OTHER ADDITIONS

Income from obligations of any state or its political subdivisions, other than RI under RIGL §44-30-12(1) and RIGL

1

1

§44-30-12(2) ...............................................................................................................................................................

2

Bonus depreciation that has been taken for federal purposes that must be added back to Rhode Island income

2

under RIGL §44-61-1 ..................................................................................................................................................

SECTION III - TAXPAYER’S OTHER DEDUCTIONS

1

Income from obligations of the US government included in Federal AGI but exempt from state income taxes ........

1

2

2

Elective deduction for new research and development facilities under RIGL §44-32-1 .............................................

3

3

Qualifying investment in a certified venture capital partnership under RIGL §44-43-2 ..............................................

Bonus depreciation that has already been taken on the Federal return that has not yet been subtracted from

4

4

Rhode Island income under RIGL §44-61-1...............................................................................................................

Section 179 depreciation that has already been taken on the Federal return that has not yet been subtracted from

5

5

Rhode Island income under RIGL §44-61-1.1............................................................................................................

6

Discharge of business indebtedness claimed as income on Federal return and previously included as RI income

6

under American Recovery and Reinvestment Act of 2009 under RIGL §44-66-1...........................................................

7

7

Tax Incentives for Employers under RIGL §44-55...........................................................................................................

SECTION IV - COMPOSITE FILING INFORMATION

1

1

Rhode Island source income included on composite filing .............................................................................................

2

2

Composite payment made on taxpayer’s behalf .............................................................................................................

SECTION V - RI-1096PT PASS-THROUGH WITHHOLDING INFORMATION

1

1

Rhode Island source income included on pass-through withholding filing ......................................................................

2

2

Pass-through withholding payment made on taxpayer’s behalf ......................................................................................

SECTION VI - TAXPAYER’S CREDIT BREAKDOWN

1

RI-2276 - Tax Credit for Contributions to Qualified Scholarship Organization - RIGL §44-62 ...........................................

1

RI-286B - Historic Preservation Investment Tax Credit - RIGL §44-33.2 and Historic Preservation Tax Credits 2013 -

2

2

RIGL §44-33.6..............................................................................................................................................................

3

RI-8201 - Motion Picture Production Company Tax Credit - RIGL §44-31.2 and Musical and Theatrical Production

3

Tax Credits - RIGL §44-31.3.........................................................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2