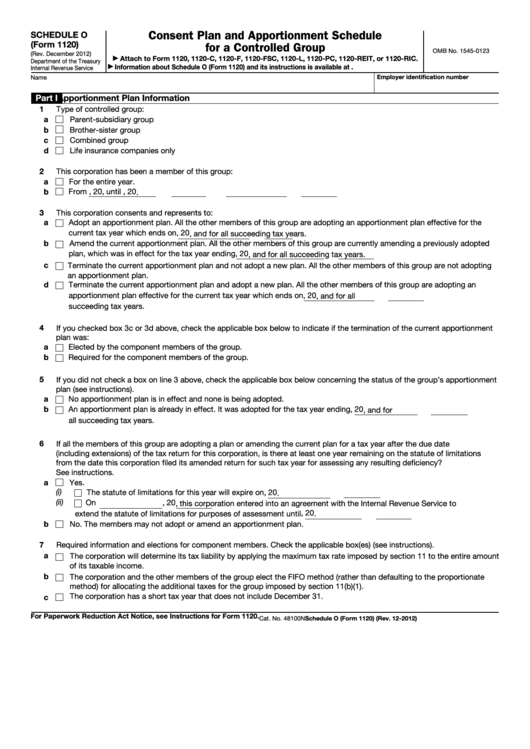

Consent Plan and Apportionment Schedule

SCHEDULE O

(Form 1120)

for a Controlled Group

OMB No. 1545-0123

(Rev. December 2012)

Attach to Form 1120, 1120-C, 1120-F, 1120-FSC, 1120-L, 1120-PC, 1120-REIT, or 1120-RIC.

▶

Department of the Treasury

Information about Schedule O (Form 1120) and its instructions is available at

Internal Revenue Service

▶

Employer identification number

Name

Part I

Apportionment Plan Information

1

Type of controlled group:

a

Parent-subsidiary group

b

Brother-sister group

c

Combined group

d

Life insurance companies only

2

This corporation has been a member of this group:

a

For the entire year.

b

From

, 20

, until

, 20

.

3

This corporation consents and represents to:

a

Adopt an apportionment plan. All the other members of this group are adopting an apportionment plan effective for the

current tax year which ends on

, 20

, and for all succeeding tax years.

b

Amend the current apportionment plan. All the other members of this group are currently amending a previously adopted

plan, which was in effect for the tax year ending

, 20

, and for all succeeding tax years.

c

Terminate the current apportionment plan and not adopt a new plan. All the other members of this group are not adopting

an apportionment plan.

d

Terminate the current apportionment plan and adopt a new plan. All the other members of this group are adopting an

apportionment plan effective for the current tax year which ends on

, 20

, and for all

succeeding tax years.

4

If you checked box 3c or 3d above, check the applicable box below to indicate if the termination of the current apportionment

plan was:

a

Elected by the component members of the group.

b

Required for the component members of the group.

5

If you did not check a box on line 3 above, check the applicable box below concerning the status of the group’s apportionment

plan (see instructions).

a

No apportionment plan is in effect and none is being adopted.

b

, 20

An apportionment plan is already in effect. It was adopted for the tax year ending

, and for

all succeeding tax years.

6

If all the members of this group are adopting a plan or amending the current plan for a tax year after the due date

(including extensions) of the tax return for this corporation, is there at least one year remaining on the statute of limitations

from the date this corporation filed its amended return for such tax year for assessing any resulting deficiency?

See instructions.

a

Yes.

(i)

The statute of limitations for this year will expire on

, 20

.

(ii)

On

, 20

, this corporation entered into an agreement with the Internal Revenue Service to

, 20

extend the statute of limitations for purposes of assessment until

.

b

No. The members may not adopt or amend an apportionment plan.

7

Required information and elections for component members. Check the applicable box(es) (see instructions).

a

The corporation will determine its tax liability by applying the maximum tax rate imposed by section 11 to the entire amount

of its taxable income.

b

The corporation and the other members of the group elect the FIFO method (rather than defaulting to the proportionate

method) for allocating the additional taxes for the group imposed by section 11(b)(1).

The corporation has a short tax year that does not include December 31.

c

For Paperwork Reduction Act Notice, see Instructions for Form 1120.

Cat. No. 48100N

Schedule O (Form 1120) (Rev. 12-2012)

1

1 2

2 3

3 4

4