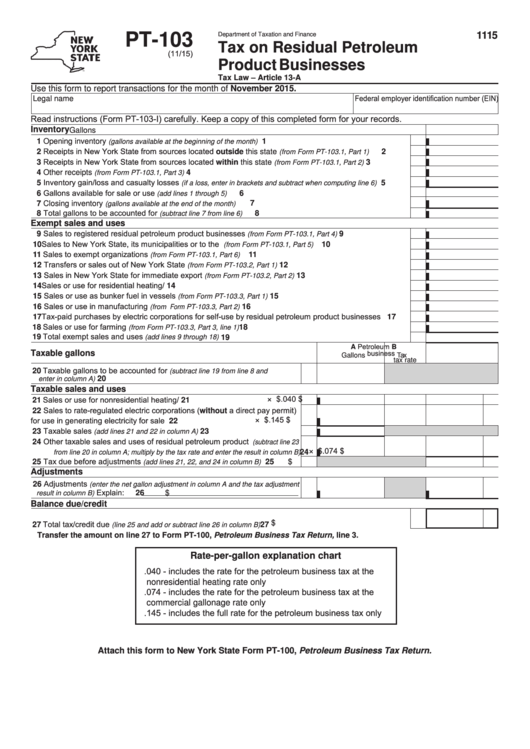

Form Pt-103 - Tax On Residual Petroleum Product Businesses

ADVERTISEMENT

1115

PT-103

Department of Taxation and Finance

Tax on Residual Petroleum

(11/15)

Product Businesses

Tax Law – Article 13-A

Use this form to report transactions for the month of November 2015.

Federal employer identification number (EIN)

Legal name

Read instructions (Form PT-103-I) carefully. Keep a copy of this completed form for your records.

Inventory

Gallons

...................................................................

1 Opening inventory

1

(gallons available at the beginning of the month)

2 Receipts in New York State from sources located outside this state

.................

2

(from Form PT-103.1, Part 1)

3 Receipts in New York State from sources located within this state

...................

3

(from Form PT-103.1, Part 2)

.....................................................................................................

4 Other receipts

4

(from Form PT-103.1, Part 3)

5 Inventory gain/loss and casualty losses

.............

5

(if a loss, enter in brackets and subtract when computing line 6)

6 Gallons available for sale or use

..................................................................................

6

(add lines 1 through 5)

.............................................................................

7

7 Closing inventory

(gallons available at the end of the month)

8 Total gallons to be accounted for

...........................................................................

8

(subtract line 7 from line 6)

Exempt sales and uses

9 Sales to registered residual petroleum product businesses

...............................

9

(from Form PT-103.1, Part 4)

10 Sales to New York State, its municipalities or to the U.S. government

............... 10

(from Form PT-103.1, Part 5)

11 Sales to exempt organizations

............................................................................ 11

(from Form PT-103.1, Part 6)

12 Transfers or sales out of New York State

............................................................ 12

(from Form PT-103.2, Part 1)

13 Sales in New York State for immediate export

.................................................... 13

(from Form PT-103.2, Part 2)

14 Sales or use for residential heating/cooling................................................................................................... 14

15 Sales or use as bunker fuel in vessels

................................................................ 15

(from Form PT-103.3, Part 1)

16 Sales or use in manufacturing

............................................................................. 16

(from Form PT-103.3, Part 2)

17 Tax-paid purchases by electric corporations for self-use by residual petroleum product businesses .......... 17

18 Sales or use for farming

............................................................................. 18

(from Form PT-103.3, Part 3, line 1)

19 Total exempt sales and uses

...................................................................................... 19

(add lines 9 through 18)

Petroleum

A

B

business

Taxable gallons

Gallons

Tax

tax rate

20 Taxable gallons to be accounted for

(subtract line 19 from line 8 and

..................................................................................... 20

enter in column A)

Taxable sales and uses

$.040

$

21 Sales or use for nonresidential heating/cooling.......................................... 21

×

22 Sales to rate-regulated electric corporations (without a direct pay permit)

$.145

$

for use in generating electricity for sale .................................................. 22

×

23 Taxable sales

............................................. 23

(add lines 21 and 22 in column A)

24 Other taxable sales and uses of residual petroleum product

(subtract line 23

$.074

$

×

24

from line 20 in column A; multiply by the tax rate and enter the result in column B)

25 Tax due before adjustments

................ 25

$

(add lines 21, 22, and 24 in column B)

Adjustments

26 Adjustments

(enter the net gallon adjustment in column A and the tax adjustment

Explain:

26

$

result in column B)

Balance due/credit

27 Total tax/credit due

.................................................................. 27 $

(line 25 and add or subtract line 26 in column B)

Transfer the amount on line 27 to Form PT-100, Petroleum Business Tax Return, line 3.

Rate-per-gallon explanation chart

.040 - includes the rate for the petroleum business tax at the

nonresidential heating rate only

.074 - includes the rate for the petroleum business tax at the

commercial gallonage rate only

.145 - includes the full rate for the petroleum business tax only

Attach this form to New York State Form PT-100, Petroleum Business Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1