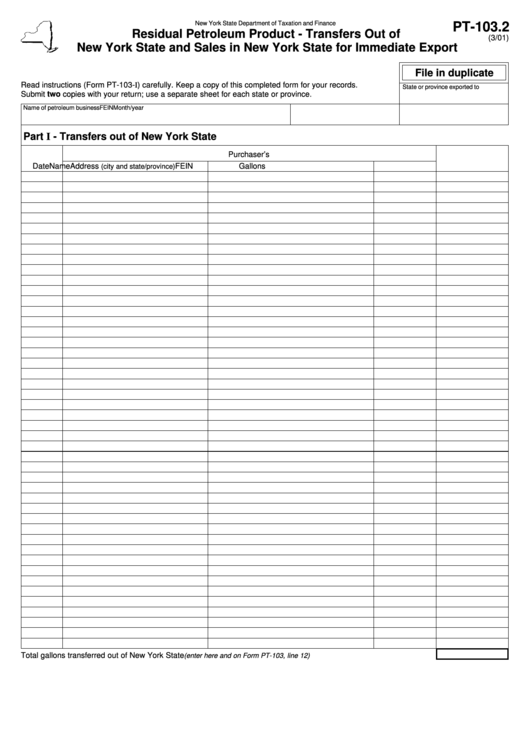

Form Pt-103.2 - Residual Petroleum Product - Transfers Out Of New York State And Sales In New York State For Immediate Export

ADVERTISEMENT

New York State Department of Taxation and Finance

PT-103.2

Residual Petroleum Product - Transfers Out of

(3/01)

New York State and Sales in New York State for Immediate Export

File in duplicate

Read instructions (Form PT-103-I) carefully. Keep a copy of this completed form for your records.

State or province exported to

Submit two copies with your return; use a separate sheet for each state or province.

Name of petroleum business

FEIN

Month/year

Part I - Transfers out of New York State

Purchaser’s

Date

Name

Address

FEIN

Gallons

(city and state/province)

Total gallons transferred out of New York State

.......................................................

(enter here and on Form PT-103, line 12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2