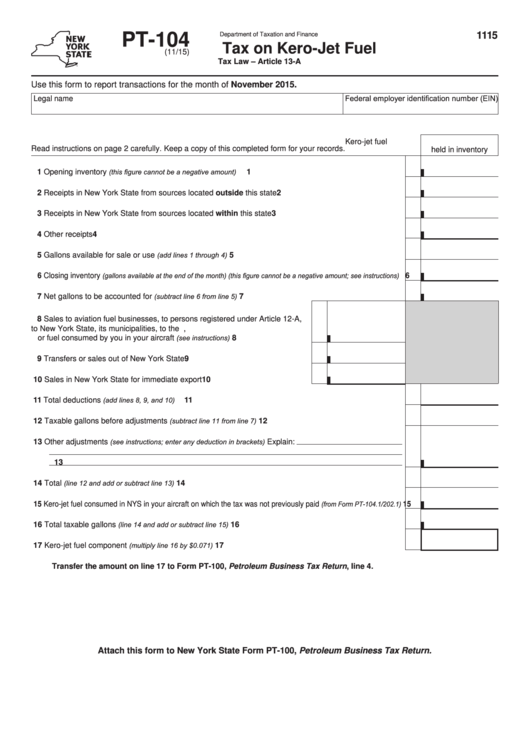

Form Pt-104 - Tax On Kero-Jet Fuel

ADVERTISEMENT

1115

PT-104

Department of Taxation and Finance

Tax on Kero-Jet Fuel

(11/15)

Tax Law – Article 13-A

Use this form to report transactions for the month of November 2015.

Federal employer identification number (EIN)

Legal name

Kero-jet fuel

Read instructions on page 2 carefully. Keep a copy of this completed form for your records.

held in inventory

(this figure cannot be a negative amount)

1 Opening inventory

...........................................................................

1

2 Receipts in New York State from sources located outside this state ........................................................

2

3 Receipts in New York State from sources located within this state ...........................................................

3

4 Other receipts .............................................................................................................................................

4

(add lines 1 through 4)

5 Gallons available for sale or use

...............................................................................

5

(gallons available at the end of the month) (this figure cannot be a negative amount; see instructions)

6 Closing inventory

6

(subtract line 6 from line 5)

7 Net gallons to be accounted for

..........................................................................

7

8 Sales to aviation fuel businesses, to persons registered under Article 12-A,

to New York State, its municipalities, to the U.S. government,

(see instructions)

or fuel consumed by you in your aircraft

............................

8

9 Transfers or sales out of New York State ........................................................

9

10 Sales in New York State for immediate export ................................................ 10

(add lines 8, 9, and 10)

11 Total deductions

.......................................................................................................

11

(subtract line 11 from line 7)

12 Taxable gallons before adjustments

.................................................................. 12

(see instructions; enter any deduction in brackets)

13 Other adjustments

Explain:

13

(line 12 and add or subtract line 13)

14 Total

........................................................................................................ 14

(from Form PT-104.1/202.1)

15 Kero-jet fuel consumed in NYS in your aircraft on which the tax was not previously paid

15

(line 14 and add or subtract line 15)

16 Total taxable gallons

............................................................................... 16

(multiply line 16 by $0.071)

17 Kero-jet fuel component

..................................................................................... 17

Transfer the amount on line 17 to Form PT-100, Petroleum Business Tax Return, line 4.

Attach this form to New York State Form PT-100, Petroleum Business Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2