Form Pt-105 - Credit/reimbursement For Registered Electric Corporations

ADVERTISEMENT

1115

PT-105

Department of Taxation and Finance

Credit / Reimbursement for

(11/15)

Registered Electric Corporations

Rate-Regulated by the Department of Public Services

Tax Law – Article 13-A

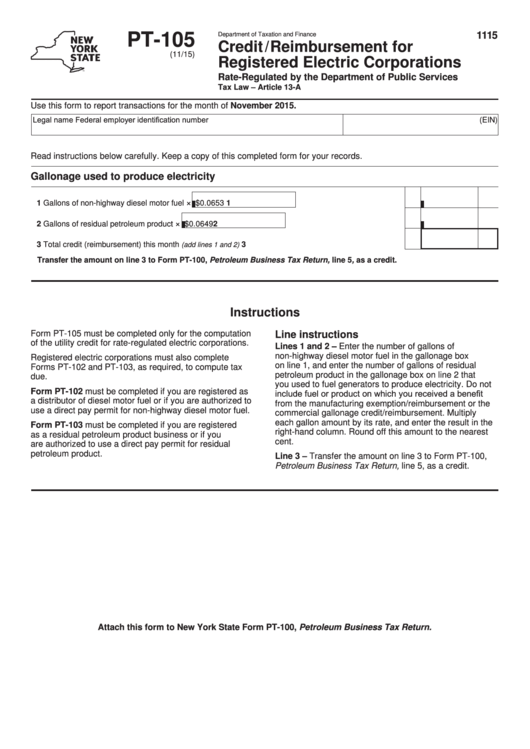

Use this form to report transactions for the month of November 2015.

Legal name

Federal employer identification number (EIN)

Read instructions below carefully. Keep a copy of this completed form for your records.

Gallonage used to produce electricity

×

1 Gallons of non-highway diesel motor fuel

$0.0653 ...........................

1

×

2 Gallons of residual petroleum product

$0.0649 .................................

2

3 Total credit (reimbursement) this month

.........................................................................

3

(add lines 1 and 2)

Transfer the amount on line 3 to Form PT-100, Petroleum Business Tax Return, line 5, as a credit.

Instructions

Form PT-105 must be completed only for the computation

Line instructions

of the utility credit for rate-regulated electric corporations.

Lines 1 and 2 – Enter the number of gallons of

non-highway diesel motor fuel in the gallonage box

Registered electric corporations must also complete

on line 1, and enter the number of gallons of residual

Forms PT-102 and PT-103, as required, to compute tax

petroleum product in the gallonage box on line 2 that

due.

you used to fuel generators to produce electricity. Do not

Form PT-102 must be completed if you are registered as

include fuel or product on which you received a benefit

a distributor of diesel motor fuel or if you are authorized to

from the manufacturing exemption/reimbursement or the

use a direct pay permit for non-highway diesel motor fuel.

commercial gallonage credit/reimbursement. Multiply

each gallon amount by its rate, and enter the result in the

Form PT-103 must be completed if you are registered

right-hand column. Round off this amount to the nearest

as a residual petroleum product business or if you

cent.

are authorized to use a direct pay permit for residual

petroleum product.

Line 3 – Transfer the amount on line 3 to Form PT-100,

Petroleum Business Tax Return, line 5, as a credit.

Attach this form to New York State Form PT-100, Petroleum Business Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1