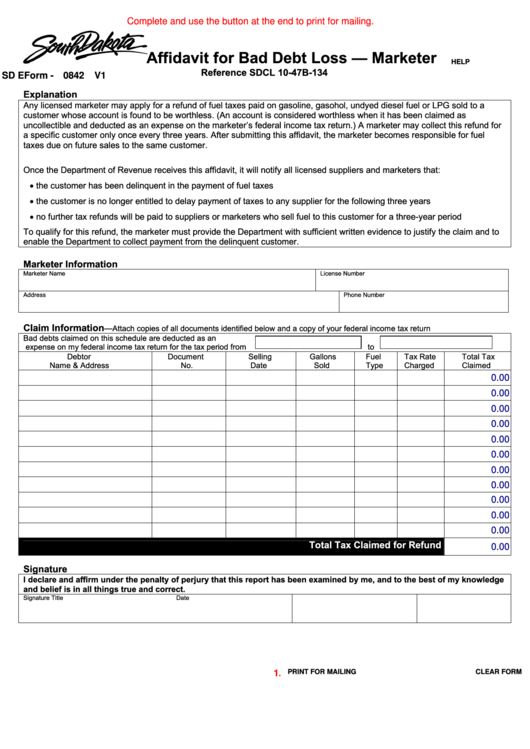

Complete and use the button at the end to print for mailing.

Affidavit for Bad Debt Loss — Marketer

HELP

Reference SDCL 10-47B-134

SD EForm - 0842

V1

Explanation

Any licensed marketer may apply for a refund of fuel taxes paid on gasoline, gasohol, undyed diesel fuel or LPG sold to a

customer whose account is found to be worthless. (An account is considered worthless when it has been claimed as

uncollectible and deducted as an expense on the marketer’s federal income tax return.) A marketer may collect this refund for

a specific customer only once every three years. After submitting this affidavit, the marketer becomes responsible for fuel

taxes due on future sales to the same customer.

Once the Department of Revenue receives this affidavit, it will notify all licensed suppliers and marketers that:

•

the customer has been delinquent in the payment of fuel taxes

•

the customer is no longer entitled to delay payment of taxes to any supplier for the following three years

•

no further tax refunds will be paid to suppliers or marketers who sell fuel to this customer for a three-year period

To qualify for this refund, the marketer must provide the Department with sufficient written evidence to justify the claim and to

enable the Department to collect payment from the delinquent customer.

Marketer Information

Marketer Name

License Number

Address

Phone Number

Claim Information

—

Attach copies of all documents identified below and a copy of your federal income tax return

Bad debts claimed on this schedule are deducted as an

expense on my federal income tax return for the tax period from

to

Debtor

Document

Selling

Gallons

Fuel

Tax Rate

Total Tax

Name & Address

No.

Date

Sold

Type

Charged

Claimed

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Total Tax Claimed for Refund

0.00

Signature

I declare and affirm under the penalty of perjury that this report has been examined by me, and to the best of my knowledge

and belief is in all things true and correct.

Signature

Title

Date

1.

PRINT FOR MAILING

CLEAR FORM

1

1