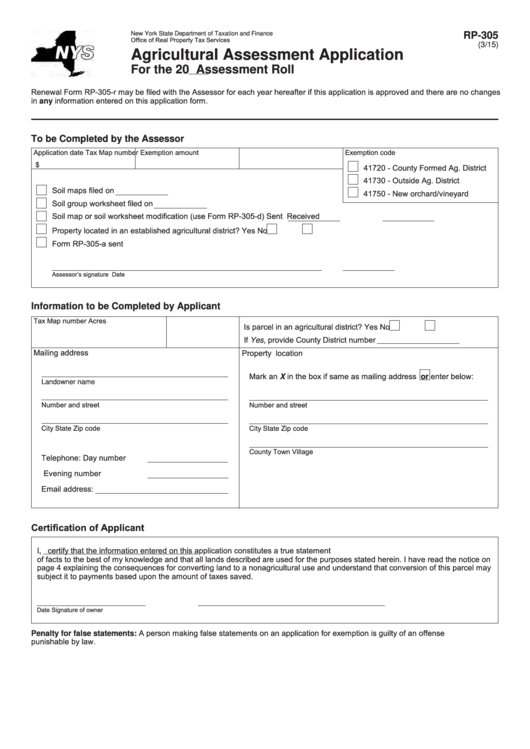

New York State Department of Taxation and Finance

RP-305

Office of Real Property Tax Services

(3/15)

Agricultural Assessment Application

For the 20

Assessment Roll

Renewal Form RP-305-r may be filed with the Assessor for each year hereafter if this application is approved and there are no changes

in any information entered on this application form.

To be Completed by the Assessor

Application date

Tax Map number

Exemption amount

Exemption code

$

41720 - County Formed Ag. District

41730 - Outside Ag. District

Soil maps filed on

41750 - New orchard/vineyard

Soil group worksheet filed on

Soil map or soil worksheet modification (use Form RP-305-d) Sent

Received

Property located in an established agricultural district?

Yes

No

Form RP-305-a sent

Assessor’s signature

Date

Information to be Completed by Applicant

Tax Map number

Acres

Is parcel in an agricultural district?

Yes

No

If Yes, provide County District number

Mailing address

Property location

Mark an X in the box if same as mailing address

or enter below:

Landowner name

Number and street

Number and street

City

State

Zip code

City

State

Zip code

County

Town

Village

Telephone:

Day number

Evening number

Email address:

Certification of Applicant

certify that the information entered on this application constitutes a true statement

I,

of facts to the best of my knowledge and that all lands described are used for the purposes stated herein. I have read the notice on

page 4 explaining the consequences for converting land to a nonagricultural use and understand that conversion of this parcel may

subject it to payments based upon the amount of taxes saved.

Date

Signature of owner

Penalty for false statements: A person making false statements on an application for exemption is guilty of an offense

punishable by law.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11