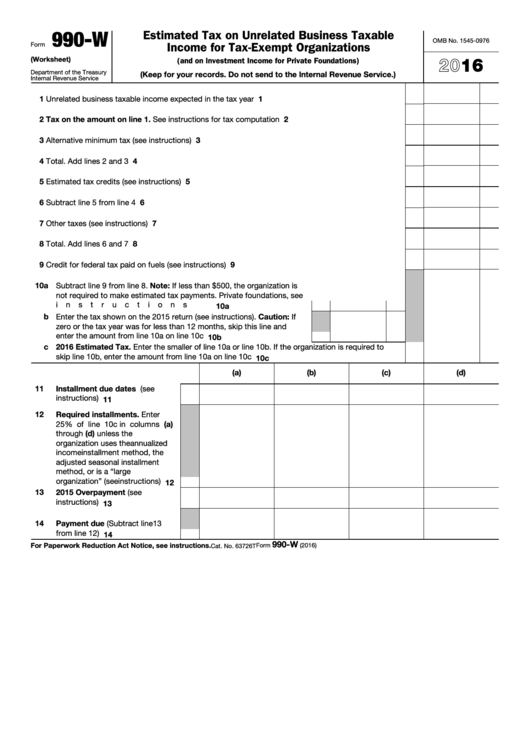

990-W

Estimated Tax on Unrelated Business Taxable

OMB No. 1545-0976

Income for Tax-Exempt Organizations

Form

2016

(Worksheet)

(and on Investment Income for Private Foundations)

Department of the Treasury

(Keep for your records. Do not send to the Internal Revenue Service.)

Internal Revenue Service

1

Unrelated business taxable income expected in the tax year .

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Tax on the amount on line 1. See instructions for tax computation

2

.

.

.

.

.

.

.

.

.

.

3

Alternative minimum tax (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Total. Add lines 2 and 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

5

Estimated tax credits (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Subtract line 5 from line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

7

Other taxes (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Total. Add lines 6 and 7 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Credit for federal tax paid on fuels (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10 a Subtract line 9 from line 8. Note: If less than $500, the organization is

not required to make estimated tax payments. Private foundations, see

instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10a

b Enter the tax shown on the 2015 return (see instructions). Caution: If

zero or the tax year was for less than 12 months, skip this line and

enter the amount from line 10a on line 10c .

.

.

.

.

.

.

.

.

.

10b

c 2016 Estimated Tax. Enter the smaller of line 10a or line 10b. If the organization is required to

skip line 10b, enter the amount from line 10a on line 10c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10c

(a)

(b)

(c)

(d)

11

Installment due dates

(see

instructions) .

.

.

.

.

.

.

11

12

Required

installments.

Enter

25% of line 10c in columns (a)

through

(d)

unless

the

organization uses the annualized

income installment method, the

adjusted

seasonal

installment

method,

or

is

a

“large

organization” (see instructions)

12

13

2015

Overpayment

(see

instructions) .

.

.

.

.

.

.

13

14

Payment due (Subtract line 13

from line 12) .

.

.

.

.

.

.

14

990-W

For Paperwork Reduction Act Notice, see instructions.

Form

(2016)

Cat. No. 63726T

1

1 2

2 3

3 4

4 5

5 6

6 7

7