Form Rev 41 0056 - Small Business B&o Tax Credit Worksheet

ADVERTISEMENT

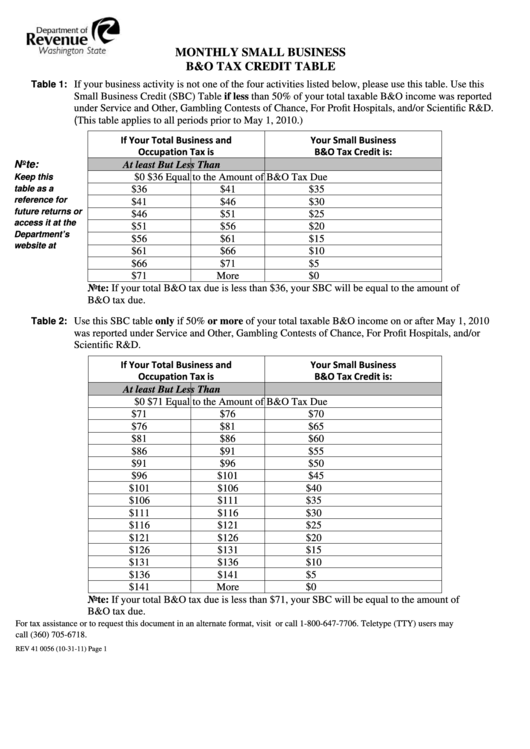

MONTHLY SMALL BUSINESS

B&O TAX CREDIT TABLE

If your business activity is not one of the four activities listed below, please use this table. Use this

Table 1:

Small Business Credit (SBC) Table if less than 50% of your total taxable B&O income was reported

under Service and Other, Gambling Contests of Chance, For Profit Hospitals, and/or Scientific R&D.

(This table applies to all periods prior to May 1, 2010.)

If Your Total Business and

Your Small Business

Occupation Tax is

B&O Tax Credit is:

Note:

At least

But Less Than

$0

$36

Equal to the Amount of B&O Tax Due

Keep this

table as a

$36

$41

$35

reference for

$41

$46

$30

future returns or

$46

$51

$25

access it at the

$51

$56

$20

Department’s

$56

$61

$15

website at

$61

$66

$10

$66

$71

$5

$71

More

$0

Note: If your total B&O tax due is less than $36, your SBC will be equal to the amount of

B&O tax due.

Table 2:

Use this SBC table only if 50% or more of your total taxable B&O income on or after May 1, 2010

was reported under Service and Other, Gambling Contests of Chance, For Profit Hospitals, and/or

Scientific R&D.

If Your Total Business and

Your Small Business

Occupation Tax is

B&O Tax Credit is:

At least

But Less Than

$0

$71

Equal to the Amount of B&O Tax Due

$71

$76

$70

$76

$81

$65

$81

$86

$60

$86

$91

$55

$91

$96

$50

$96

$101

$45

$101

$106

$40

$106

$111

$35

$111

$116

$30

$116

$121

$25

$121

$126

$20

$126

$131

$15

$131

$136

$10

$136

$141

$5

$141

More

$0

Note: If your total B&O tax due is less than $71, your SBC will be equal to the amount of

B&O tax due.

For tax assistance or to request this document in an alternate format, visit or call 1-800-647-7706. Teletype (TTY) users may

call (360) 705-6718.

REV 41 0056 (10-31-11)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2