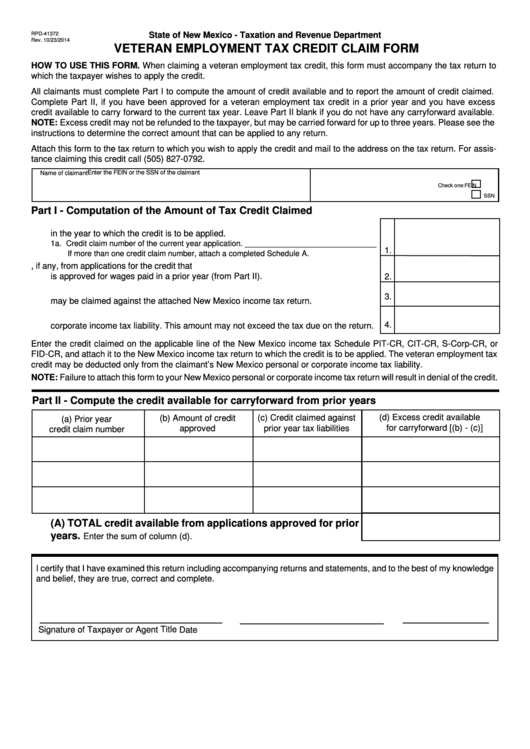

RPD-41372

State of New Mexico - Taxation and Revenue Department

Rev. 10/23/2014

VETERAN EMPLOYMENT TAX CREDIT CLAIM FORM

HOW TO USE THIS FORM. When claiming a veteran employment tax credit, this form must accompany the tax return to

which the taxpayer wishes to apply the credit.

All claimants must complete Part I to compute the amount of credit available and to report the amount of credit claimed.

Complete Part II, if you have been approved for a veteran employment tax credit in a prior year and you have excess

credit available to carry forward to the current tax year. Leave Part II blank if you do not have any carryforward available.

NOTE: Excess credit may not be refunded to the taxpayer, but may be carried forward for up to three years. Please see the

instructions to determine the correct amount that can be applied to any return.

Attach this form to the tax return to which you wish to apply the credit and mail to the address on the tax return. For assis-

tance claiming this credit call (505) 827-0792.

Enter the FEIN or the SSN of the claimant

Name of claimant

Check one:

FEIN

SSN

Part I - Computation of the Amount of Tax Credit Claimed

1.

Enter the total veteran employment tax credit approved for wages paid to the veteran

in the year to which the credit is to be applied.

1a. Credit claim number of the current year application. ______________________________

1.

If more than one credit claim number, attach a completed Schedule A.

2.

Enter total credit available for carry forward, if any, from applications for the credit that

is approved for wages paid in a prior year (from Part II).

2.

3.

Enter the sum of lines 1 and 2. This is the available veteran employment tax credit that

3.

may be claimed against the attached New Mexico income tax return.

4.

Enter the portion of available credit you wish to apply to the current NM personal or

4.

corporate income tax liability. This amount may not exceed the tax due on the return.

Enter the credit claimed on the applicable line of the New Mexico income tax Schedule PIT-CR, CIT-CR, S-Corp-CR, or

FID-CR, and attach it to the New Mexico income tax return to which the credit is to be applied. The veteran employment tax

credit may be deducted only from the claimant’s New Mexico personal or corporate income tax liability.

NOTE: Failure to attach this form to your New Mexico personal or corporate income tax return will result in denial of the credit.

Part II - Compute the credit available for carryforward from prior years

(d) Excess credit available

(b) Amount of credit

(c) Credit claimed against

(a) Prior year

for carryforward [(b) - (c)]

approved

prior year tax liabilities

credit claim number

(A) TOTAL credit available from applications approved for prior

Enter the sum of column (d).

years.

I certify that I have examined this return including accompanying returns and statements, and to the best of my knowledge

and belief, they are true, correct and complete.

Signature of Taxpayer or Agent

Title

Date

1

1 2

2 3

3