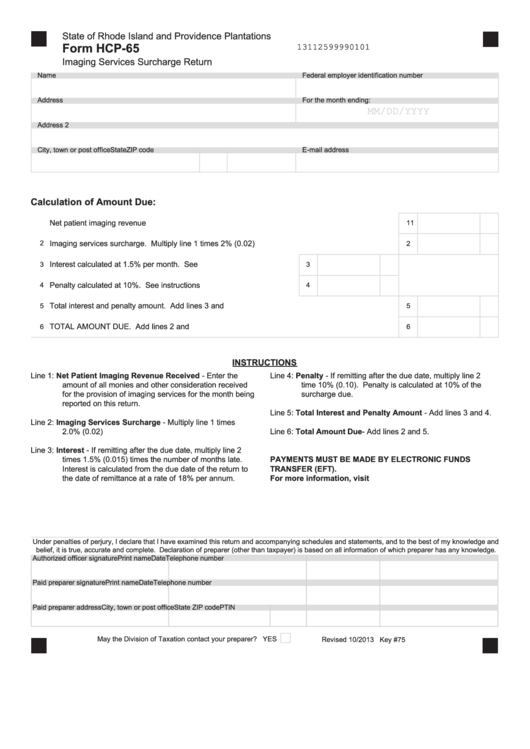

State of Rhode Island and Providence Plantations

Form HCP-65

13112599990101

Imaging Services Surcharge Return

Name

Federal employer identification number

Address

For the month ending:

MM/DD/YYYY

Address 2

City, town or post office

State

ZIP code

E-mail address

Calculation of Amount Due:

Net patient imaging revenue received.....................................................................................................

1

1

2

Imaging services surcharge. Multiply line 1 times 2% (0.02)..................................................................

2

Interest calculated at 1.5% per month. See instructions..........................

3

3

4

Penalty calculated at 10%. See instructions ...........................................

4

Total interest and penalty amount. Add lines 3 and 4.............................................................................

5

5

TOTAL AMOUNT DUE. Add lines 2 and 5..............................................................................................

6

6

INSTRUCTIONS

Line 1: Net Patient Imaging Revenue Received - Enter the

Line 4: Penalty - If remitting after the due date, multiply line 2

amount of all monies and other consideration received

time 10% (0.10). Penalty is calculated at 10% of the

for the provision of imaging services for the month being

surcharge due.

reported on this return.

Line 5: Total Interest and Penalty Amount - Add lines 3 and 4.

Line 2: Imaging Services Surcharge - Multiply line 1 times

2.0% (0.02)

Line 6: Total Amount Due - Add lines 2 and 5.

Line 3: Interest - If remitting after the due date, multiply line 2

times 1.5% (0.015) times the number of months late.

PAYMENTS MUST BE MADE BY ELECTRONIC FUNDS

Interest is calculated from the due date of the return to

TRANSFER (EFT).

the date of remittance at a rate of 18% per annum.

For more information, visit .

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP code

PTIN

May the Division of Taxation contact your preparer? YES

1

1