Form Pt-351 - Aircraft Fuel Consumption Tax Return

ADVERTISEMENT

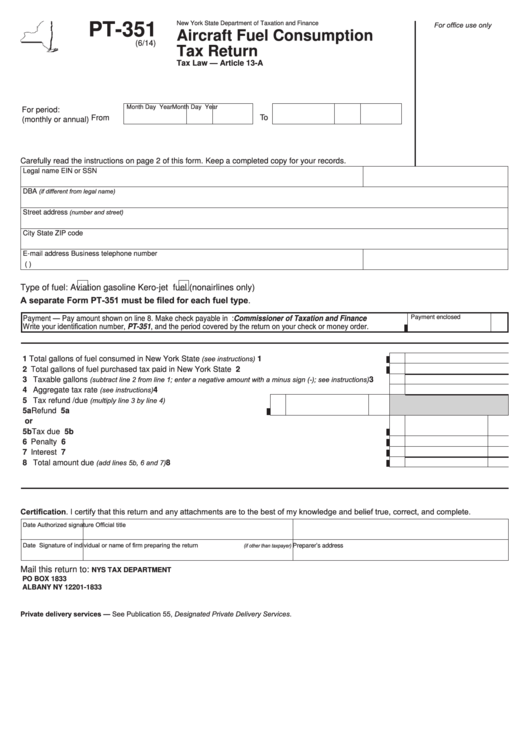

New York State Department of Taxation and Finance

For office use only

PT-351

Aircraft Fuel Consumption

(6/14)

Tax Return

Tax Law — Article 13-A

Month

Day

Year

Month

Day

Year

For period:

To

From

(monthly or annual)

Carefully read the instructions on page 2 of this form. Keep a completed copy for your records.

Legal name

EIN or SSN

(if different from legal name)

DBA

(number and street)

Street address

City

State

ZIP code

E-mail address

Business telephone number

(

)

Type of fuel:

Aviation gasoline

Kero-jet fuel (nonairlines only)

A separate Form PT-351 must be filed for each fuel type.

Payment — Pay amount shown on line 8. Make check payable in U.S. funds to: Commissioner of Taxation and Finance

Payment enclosed

Write your identification number, PT-351, and the period covered by the return on your check or money order.

(see instructions)

1 Total gallons of fuel consumed in New York State

.........................................................

1

2 Total gallons of fuel purchased tax paid in New York State .....................................................................

2

(subtract line 2 from line 1; enter a negative amount with a minus sign (-); see instructions)

3 Taxable gallons

.......

3

(see instructions)

4 Aggregate tax rate

..........................................................................................................

4

(multiply line 3 by line 4)

5 Tax refund /due

5a

Refund ..................................................................................

5a

or

5b Tax due ....................................................................................................................................................

5b

6 Penalty ....................................................................................................................................................

6

7 Interest ....................................................................................................................................................

7

(add lines 5b, 6 and 7)

8 Total amount due

...................................................................................................

8

Certification. I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Date

Authorized signature

Official title

Date

Signature of individual or name of firm preparing the return

(if other than taxpayer)

Preparer’s address

Mail this return to:

NYS TAX DEPARTMENT

PO BOX 1833

ALBANY NY 12201-1833

Private delivery services — See Publication 55, Designated Private Delivery Services.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2