Form Ri-100a - Rhode Island Estate Tax Return

ADVERTISEMENT

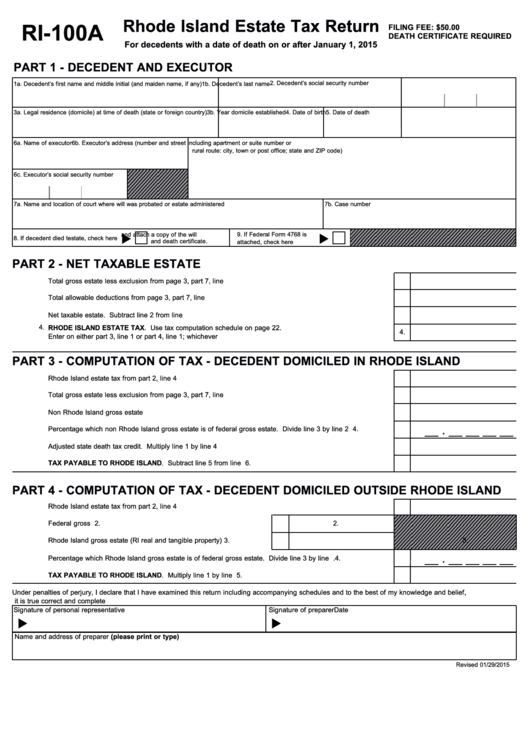

Rhode Island Estate Tax Return

FILING FEE: $50.00

RI-100A

DEATH CERTIFICATE REQUIRED

For decedents with a date of death on or after January 1, 2015

PART 1 - DECEDENT AND EXECUTOR

2. Decedent’s social security number

1a. Decedent’s first name and middle initial (and maiden name, if any)

1b. Decedent’s last name

3a. Legal residence (domicile) at time of death (state or foreign country)

3b. Year domicile established

4. Date of birth

5. Date of death

6a. Name of executor

6b. Executor’s address (number and street including apartment or suite number or

rural route: city, town or post office; state and ZIP code)

6c. Executor’s social security number

7a. Name and location of court where will was probated or estate administered

7b. Case number

u

u

and attach a copy of the will

9. If Federal Form 4768 is

8. If decedent died testate, check here

and death certificate.

attached, check here

PART 2 - NET TAXABLE ESTATE

1.

Total gross estate less exclusion from page 3, part 7, line 12......................................................................................

1.

2.

Total allowable deductions from page 3, part 7, line 23................................................................................................

2.

3.

Net taxable estate. Subtract line 2 from line 1.............................................................................................................

3.

4.

RHODE ISLAND ESTATE TAX. Use tax computation schedule on page 22.

4.

Enter on either part 3, line 1 or part 4, line 1; whichever applies..................................................................................

PART 3 - COMPUTATION OF TAX - DECEDENT DOMICILED IN RHODE ISLAND

1.

Rhode Island estate tax from part 2, line 4 above.........................................................................................................

1.

2.

Total gross estate less exclusion from page 3, part 7, line 12......................................................................................

2.

3.

Non Rhode Island gross estate ....................................................................................................................................

3.

__ . __ __ __ __

4.

Percentage which non Rhode Island gross estate is of federal gross estate. Divide line 3 by line 2 .........................

4.

5.

Adjusted state death tax credit. Multiply line 1 by line 4 .............................................................................................

5.

6.

TAX PAYABLE TO RHODE ISLAND. Subtract line 5 from line 1................................................................................

6.

PART 4 - COMPUTATION OF TAX - DECEDENT DOMICILED OUTSIDE RHODE ISLAND

1.

Rhode Island estate tax from part 2, line 4 above.........................................................................................................

1.

2.

Federal gross estate.....................................................................................

2.

3.

Rhode Island gross estate (RI real and tangible property)...........................

3.

__ . __ __ __ __

4.

Percentage which Rhode Island gross estate is of federal gross estate. Divide line 3 by line 2.................................

4.

5.

TAX PAYABLE TO RHODE ISLAND. Multiply line 1 by line 4....................................................................................

5.

Under penalties of perjury, I declare that I have examined this return including accompanying schedules and to the best of my knowledge and belief,

it is true correct and complete

Signature of personal representative

Date

Signature of preparer

Date

u

u

Name and address of preparer (please print or type)

Revised 01/29/2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22