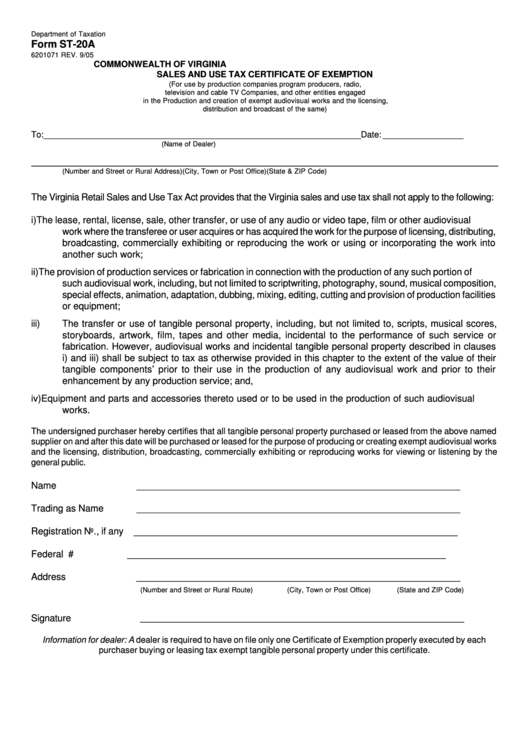

Department of Taxation

Form ST-20A

6201071 REV. 9/05

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

(For use by production companies

program producers, radio,

,

television and cable TV Companies, and other entities engaged

in the Production and creation of exempt audiovisual works and the licensing,

distribution and broadcast of the same)

To: ___________________________________________________________________ Date: _________________

(Name of Dealer)

(Number and Street or Rural Address)

(City, Town or Post Office)

(State & ZIP Code)

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to the following:

i)

The lease, rental, license, sale, other transfer, or use of any audio or video tape, film or other audiovisual

work where the transferee or user acquires or has acquired the work for the purpose of licensing, distributing,

broadcasting, commercially exhibiting or reproducing the work or using or incorporating the work into

another such work;

ii)

The provision of production services or fabrication in connection with the production of any such portion of

such audiovisual work, including, but not limited to scriptwriting, photography, sound, musical composition,

special effects, animation, adaptation, dubbing, mixing, editing, cutting and provision of production facilities

or equipment;

iii)

The transfer or use of tangible personal property, including, but not limited to, scripts, musical scores,

storyboards, artwork, film, tapes and other media, incidental to the performance of such service or

fabrication. However, audiovisual works and incidental tangible personal property described in clauses

i) and iii) shall be subject to tax as otherwise provided in this chapter to the extent of the value of their

tangible components’ prior to their use in the production of any audiovisual work and prior to their

enhancement by any production service; and,

iv)

Equipment and parts and accessories thereto used or to be used in the production of such audiovisual

works.

The undersigned purchaser hereby certifies that all tangible personal property purchased or leased from the above named

supplier on and after this date will be purchased or leased for the purpose of producing or creating exempt audiovisual works

and the licensing, distribution, broadcasting, commercially exhibiting or reproducing works for viewing or listening by the

general public.

Name

______________________________________________________________

Trading as Name

______________________________________________________________

Registration No., if any

______________________________________________________________

Federal I.D. #

_____________________________________________________________

Address

______________________________________________________________

(Number and Street or Rural Route)

(City, Town or Post Office)

(State and ZIP Code)

Signature

______________________________________________________________

Information for dealer: A dealer is required to have on file only one Certificate of Exemption properly executed by each

purchaser buying or leasing tax exempt tangible personal property under this certificate.

1

1