Form 706me - Worksheet D

ADVERTISEMENT

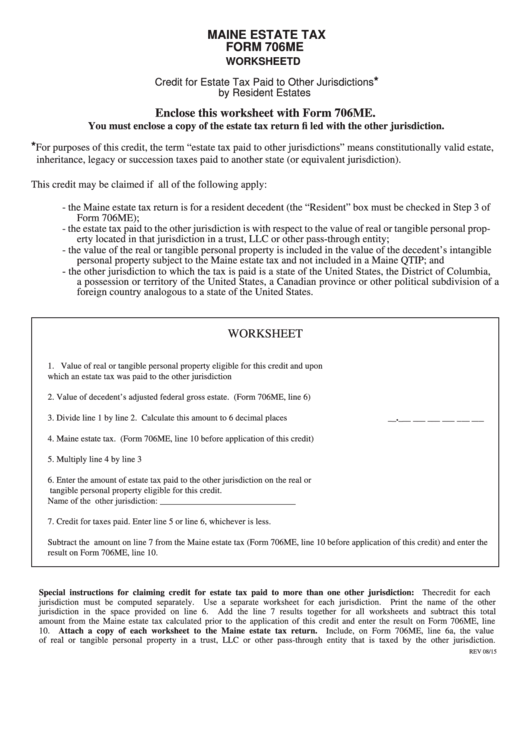

MAINE ESTATE TAX

FORM 706ME

WORKSHEET D

*

Credit for Estate Tax Paid to Other Jurisdictions

by Resident Estates

Enclose this worksheet with Form 706ME.

You must enclose a copy of the estate tax return fi led with the other jurisdiction.

*

For purposes of this credit, the term “estate tax paid to other jurisdictions” means constitutionally valid estate,

inheritance, legacy or succession taxes paid to another state (or equivalent jurisdiction).

This credit may be claimed if all of the following apply:

-

the Maine estate tax return is for a resident decedent (the “Resident” box must be checked in Step 3 of

Form 706ME);

-

the estate tax paid to the other jurisdiction is with respect to the value of real or tangible personal prop-

erty located in that jurisdiction in a trust, LLC or other pass-through entity;

-

the value of the real or tangible personal property is included in the value of the decedent’s intangible

personal property subject to the Maine estate tax and not included in a Maine QTIP; and

-

the other jurisdiction to which the tax is paid is a state of the United States, the District of Columbia,

a possession or territory of the United States, a Canadian province or other political subdivision of a

foreign country analogous to a state of the United States.

WORKSHEET

1. Value of real or tangible personal property eligible for this credit and upon

which an estate tax was paid to the other jurisdiction ............................................................1._______________________

2. Value of decedent’s adjusted federal gross estate. (Form 706ME, line 6).............................2._______________________

3. Divide line 1 by line 2. Calculate this amount to 6 decimal places .......................................3. ___.___ ___ ___ ___ ___ ___

4. Maine estate tax. (Form 706ME, line 10 before application of this credit) ..........................4._______________________

5. Multiply line 4 by line 3 .........................................................................................................5._______________________

6. Enter the amount of estate tax paid to the other jurisdiction on the real or

tangible personal property eligible for this credit.

Name of the other jurisdiction: _______________________________ .............................6._______________________

7. Credit for taxes paid. Enter line 5 or line 6, whichever is less. ..............................................7._______________________

Subtract the amount on line 7 from the Maine estate tax (Form 706ME, line 10 before application of this credit) and enter the

result on Form 706ME, line 10.

Special instructions for claiming credit for estate tax paid to more than one other jurisdiction: The credit for each

jurisdiction must be computed separately. Use a separate worksheet for each jurisdiction. Print the name of the other

jurisdiction in the space provided on line 6. Add the line 7 results together for all worksheets and subtract this total

amount from the Maine estate tax calculated prior to the application of this credit and enter the result on Form 706ME, line

10. Attach a copy of each worksheet to the Maine estate tax return. Include, on Form 706ME, line 6a, the value

of real or tangible personal property in a trust, LLC or other pass-through entity that is taxed by the other jurisdiction.

REV 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1