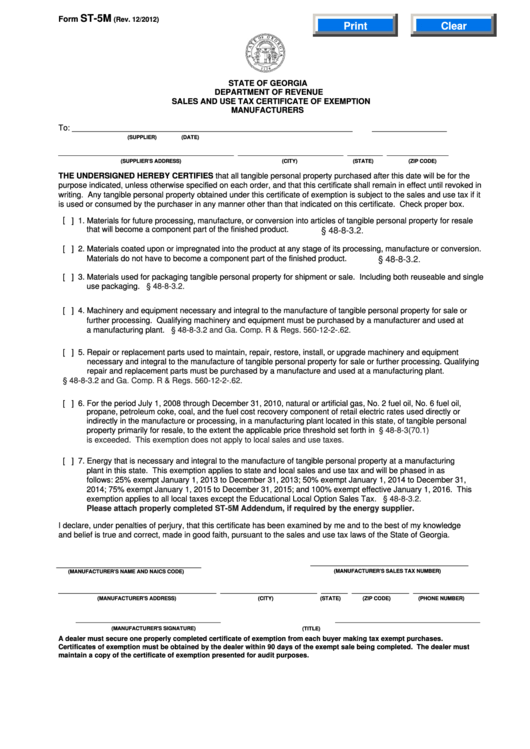

ST-5M

Form

(Rev. 12/2012)

Print

Clear

STATE OF GEORGIA

DEPARTMENT OF REVENUE

SALES AND USE TAX CERTIFICATE OF EXEMPTION

MANUFACTURERS

To: ________________________________________________________________

_________________

(SUPPLIER)

(DATE)

________________________________________ ________________________ ________

______________

(SUPPLIER’S ADDRESS)

(CITY)

(STATE)

(ZIP CODE)

THE UNDERSIGNED HEREBY CERTIFIES that all tangible personal property purchased after this date will be for the

purpose indicated, unless otherwise specified on each order, and that this certificate shall remain in effect until revoked in

writing. Any tangible personal property obtained under this certificate of exemption is subject to the sales and use tax if it

is used or consumed by the purchaser in any manner other than that indicated on this certificate. Check proper box.

[ ] 1. Materials for future processing, manufacture, or conversion into articles of tangible personal property for resale

that will become a component part of the finished product. O.C.G.A.

§ 48-8-3.2.

[ ] 2. Materials coated upon or impregnated into the product at any stage of its processing, manufacture or conversion.

Materials do not have to become a component part of the finished product. O.C.G.A.

§ 48-8-3.2.

[ ] 3. Materials used for packaging tangible personal property for shipment or sale. Including both reuseable and single

use packaging. O.C.G.A.

§ 48-8-3.2.

[ ] 4. Machinery and equipment necessary and integral to the manufacture of tangible personal property for sale or

further processing. Qualifying machinery and equipment must be purchased by a manufacturer and used at

a manufacturing plant. O.C.G.A.

§ 48-8-3.2 and Ga. Comp. R & Regs. 560-12-2-.62.

[ ] 5. Repair or replacement parts used to maintain, repair, restore, install, or upgrade machinery and equipment

necessary and integral to the manufacture of tangible personal property for sale or further processing. Qualifying

repair and replacement parts must be purchased by a manufacture and used at a manufacturing plant.

O.C.G.A.

§ 48-8-3.2 and Ga. Comp. R & Regs. 560-12-2-.62.

[ ] 6. For the period July 1, 2008 through December 31, 2010, natural or artificial gas, No. 2 fuel oil, No. 6 fuel oil,

propane, petroleum coke, coal, and the fuel cost recovery component of retail electric rates used directly or

indirectly in the manufacture or processing, in a manufacturing plant located in this state, of tangible personal

property primarily for resale, to the extent the applicable price threshold set forth in O.C.G.A.

§ 48-8-3(70.1)

is exceeded. This exemption does not apply to local sales and use taxes.

[ ] 7. Energy that is necessary and integral to the manufacture of tangible personal property at a manufacturing

plant in this state. This exemption applies to state and local sales and use tax and will be phased in as

follows: 25% exempt January 1, 2013 to December 31, 2013; 50% exempt January 1, 2014 to December 31,

2014; 75% exempt January 1, 2015 to December 31, 2015; and 100% exempt effective January 1, 2016. This

exemption applies to all local taxes except the Educational Local Option Sales Tax. O.C.G.A

§ 48-8-3.2.

Please attach properly completed ST-5M Addendum, if required by the energy supplier.

I declare, under penalties of perjury, that this certificate has been examined by me and to the best of my knowledge

and belief is true and correct, made in good faith, pursuant to the sales and use tax laws of the State of Georgia.

____________________________________

_________________________________

(MANUFACTURER’S SALES TAX NUMBER)

(MANUFACTURER’S NAME AND NAICS CODE)

____________________________________ ______________________ ______ _____________ _______________

(MANUFACTURER’S ADDRESS)

(CITY)

(STATE)

(ZIP CODE)

(PHONE NUMBER)

_________________________________

_________________________________

(MANUFACTURER'S SIGNATURE)

(TITLE)

A dealer must secure one properly completed certificate of exemption from each buyer making tax exempt purchases.

Certificates of exemption must be obtained by the dealer within 90 days of the exempt sale being completed. The dealer must

maintain a copy of the certificate of exemption presented for audit purposes.

1

1