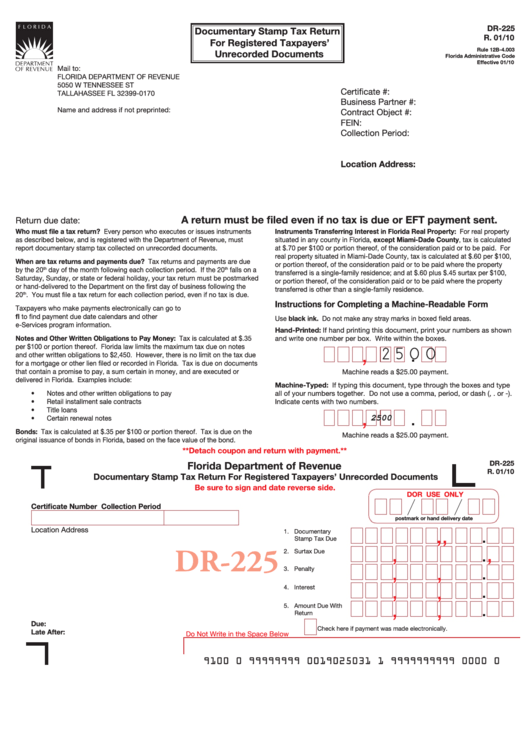

DR-225

Documentary Stamp Tax Return

R. 01/10

For Registered Taxpayers’

Rule 12B-4.003

Unrecorded Documents

Florida Administrative Code

Effective 01/10

Mail to:

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

Certificate #:

TALLAHASSEE FL 32399-0170

Business Partner #:

Name and address if not preprinted:

Contract Object #:

FEIN:

Collection Period:

Location Address:

A return must be filed even if no tax is due or EFT payment sent.

Return due date:

Who must file a tax return? Every person who executes or issues instruments

Instruments Transferring Interest in Florida Real Property: For real property

as described below, and is registered with the Department of Revenue, must

situated in any county in Florida, except Miami-Dade County, tax is calculated

report documentary stamp tax collected on unrecorded documents.

at $.70 per $100 or portion thereof, of the consideration paid or to be paid. For

real property situated in Miami-Dade County, tax is calculated at $.60 per $100,

When are tax returns and payments due? Tax returns and payments are due

or portion thereof, of the consideration paid or to be paid where the property

by the 20

day of the month following each collection period. If the 20

falls on a

th

th

transferred is a single-family residence; and at $.60 plus $.45 surtax per $100,

Saturday, Sunday, or state or federal holiday, your tax return must be postmarked

or portion thereof, of the consideration paid or to be paid where the property

or hand-delivered to the Department on the first day of business following the

transferred is other than a single-family residence.

20

. You must file a tax return for each collection period, even if no tax is due.

th

Instructions for Completing a Machine-Readable Form

Taxpayers who make payments electronically can go to

to find payment due date calendars and other

Use black ink. Do not make any stray marks in boxed field areas.

e-Services program information.

Hand-Printed: If hand printing this document, print your numbers as shown

Notes and Other Written Obligations to Pay Money: Tax is calculated at $.35

and write one number per box. Write within the boxes.

per $100 or portion thereof. Florida law limits the maximum tax due on notes

,

2 5

0 0

and other written obligations to $2,450. However, there is no limit on the tax due

for a mortgage or other lien filed or recorded in Florida. Tax is due on documents

that contain a promise to pay, a sum certain in money, and are executed or

Machine reads a $25.00 payment.

delivered in Florida. Examples include:

Machine-Typed: If typing this document, type through the boxes and type

•

Notes and other written obligations to pay

all of your numbers together. Do not use a comma, period, or dash (, . or -).

•

Retail installment sale contracts

Indicate cents with two numbers.

•

Title loans

,

•

Certain renewal notes

2500

Bonds: Tax is calculated at $.35 per $100 or portion thereof. Tax is due on the

Machine reads a $25.00 payment.

original issuance of bonds in Florida, based on the face value of the bond.

**Detach coupon and return with payment.**

Florida Department of Revenue

DR-225

R. 01/10

Documentary Stamp Tax Return For Registered Taxpayers’ Unrecorded Documents

Be sure to sign and date reverse side.

DOR USE ONLY

Certificate Number

Collection Period

postmark or hand delivery date

,

,

Location Address

1. Documentary

Stamp Tax Due

,

,

DR-225

2. Surtax Due

,

,

3. Penalty

,

,

4. Interest

,

,

5. Amount Due With

Return

Due:

Check here if payment was made electronically.

Late After:

Do Not Write in the Space Below

9100 0 99999999 0019025031 1 9999999999 0000 0

1

1 2

2