Reset This Form

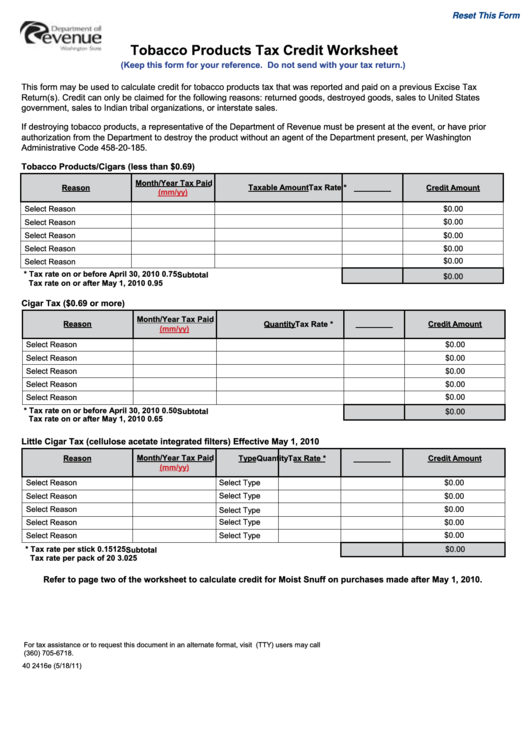

Tobacco Products Tax Credit Worksheet

(Keep this form for your reference. Do not send with your tax return.)

This form may be used to calculate credit for tobacco products tax that was reported and paid on a previous Excise Tax

Return(s). Credit can only be claimed for the following reasons: returned goods, destroyed goods, sales to United States

government, sales to Indian tribal organizations, or interstate sales.

If destroying tobacco products, a representative of the Department of Revenue must be present at the event, or have prior

authorization from the Department to destroy the product without an agent of the Department present, per Washington

Administrative Code 458-20-185.

Tobacco Products/Cigars (less than $0.69)

Month/Year Tax Paid

Reason

Taxable Amount

Tax Rate *

Credit Amount

(mm/yy)

Select Reason

$0.00

Select Reason

$0.00

Select Reason

$0.00

Select Reason

$0.00

Select Reason

$0.00

* Tax rate on or before April 30, 2010

0.75

Subtotal

$0.00

Tax rate on or after May 1, 2010

0.95

Cigar Tax ($0.69 or more)

Month/Year Tax Paid

Reason

Quantity

Tax Rate *

Credit Amount

(mm/yy)

Select Reason

$0.00

Select Reason

$0.00

Select Reason

$0.00

Select Reason

$0.00

$0.00

Select Reason

* Tax rate on or before April 30, 2010

0.50

Subtotal

$0.00

Tax rate on or after May 1, 2010

0.65

Little Cigar Tax (cellulose acetate integrated filters) Effective May 1, 2010

Reason

Month/Year Tax Paid

Type

Quantity

Tax Rate *

Credit Amount

(mm/yy)

Select Reason

Select Type

$0.00

Select Reason

Select Type

$0.00

Select Reason

$0.00

Select Type

Select Reason

Select Type

$0.00

Select Reason

Select Type

$0.00

* Tax rate per stick

0.15125

$0.00

Subtotal

Tax rate per pack of 20

3.025

Refer to page two of the worksheet to calculate credit for Moist Snuff on purchases made after May 1, 2010.

For tax assistance or to request this document in an alternate format, visit or call 1-800-647-7706. Teletype (TTY) users may call

(360) 705-6718.

40 2416e (5/18/11)

1

1 2

2