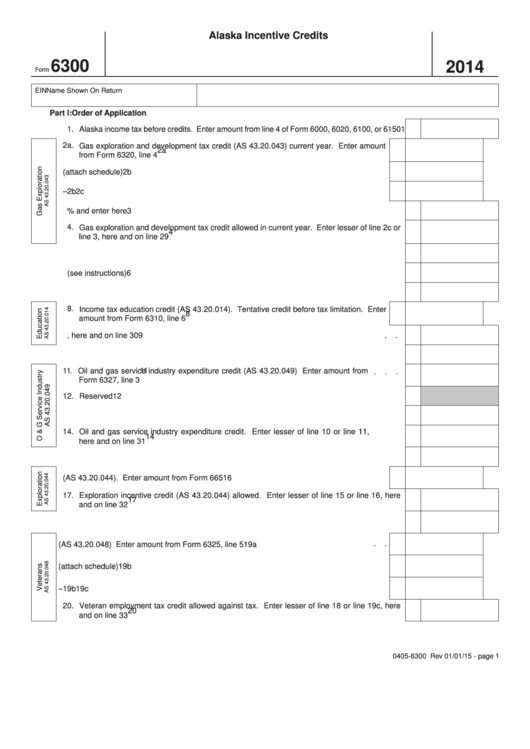

Alaska Incentive Credits

6300

2014

Form

EIN

Name Shown On Return

Part I: Order of Application

1. Alaska income tax before credits. Enter amount from line 4 of Form 6000, 6020, 6100, or 6150

1

2a. Gas exploration and development tax credit (AS 43.20.043) current year. Enter amount

2a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

from Form 6320, line 4

2b. Gas exploration and development tax credit carryover (attach schedule)

.

.

.

.

.

.

2b

2c. Tentative credit before tax limitation. Add amounts on lines 2a–2b

.

.

.

.

.

.

.

.

2c

3. Multiply line 1 by 75% and enter here

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4. Gas exploration and development tax credit allowed in current year. Enter lesser of line 2c or

4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

line 3, here and on line 29

5. Subtract line 4 from line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6. Alaska other taxes (see instructions)

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7. Add lines 5 and 6

7

8. Income tax education credit (AS 43.20.014). Tentative credit before tax limitation. Enter

8

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

amount from Form 6310, line 6

9. Income tax education credit allowed. Enter lesser of line 7 or line 8, here and on line 30

.

.

9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10. Subtract line 9 from line 7

10

11. Oil and gas service industry expenditure credit (AS 43.20.049) Enter amount from

11

.

.

.

Form 6327, line 3

12. Reserved

12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13. Tentative credit before tax limitation. Add lines 11-12

13

14. Oil and gas service industry expenditure credit. Enter lesser of line 10 or line 11,

14

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

here and on line 31

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15. Subtract line 14 from line 10

15

.

.

.

.

.

16. Exploration incentive credit (AS 43.20.044). Enter amount from Form 665

16

17. Exploration incentive credit (AS 43.20.044) allowed. Enter lesser of line 15 or line 16, here

17

and on line 32

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18. Subtract line 17 from line 15

18

.

.

19a. Veteran employment tax credit (AS 43.20.048) Enter amount from Form 6325, line 5

19a

19b. Veteran employment tax credit carryover (attach schedule)

19b

.

.

.

.

.

.

.

.

.

.

19c. Tentative credit before tax limitation. Add amounts on lines 19a–19b

.

.

.

.

.

.

.

19c

20. Veteran employment tax credit allowed against tax. Enter lesser of line 18 or line 19c, here

20

and on line 33

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0405-6300 Rev 01/01/15 - page 1

1

1 2

2