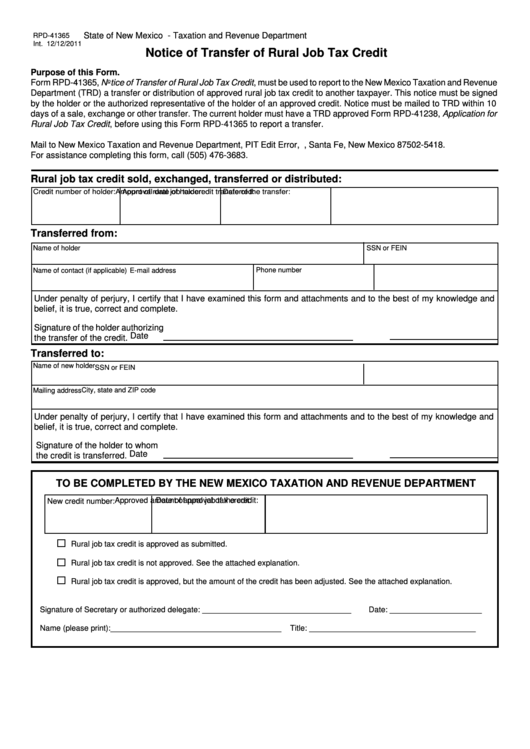

State of New Mexico - Taxation and Revenue Department

RPD-41365

Int. 12/12/2011

Notice of Transfer of Rural Job Tax Credit

Purpose of this Form.

Form RPD-41365, Notice of Transfer of Rural Job Tax Credit, must be used to report to the New Mexico Taxation and Revenue

Department (TRD) a transfer or distribution of approved rural job tax credit to another taxpayer. This notice must be signed

by the holder or the authorized representative of the holder of an approved credit. Notice must be mailed to TRD within 10

days of a sale, exchange or other transfer. The current holder must have a TRD approved Form RPD-41238, Application for

Rural Job Tax Credit, before using this Form RPD-41365 to report a transfer.

Mail to New Mexico Taxation and Revenue Department, PIT Edit Error, P.O. Box 5418, Santa Fe, New Mexico 87502-5418.

For assistance completing this form, call (505) 476-3683.

Rural job tax credit sold, exchanged, transferred or distributed:

Credit number of holder:

Approval date of holder:

Date of the transfer:

Amount of rural job tax credit transferred:

Transferred from:

Name of holder

SSN or FEIN

Phone number

Name of contact (if applicable)

E-mail address

Under penalty of perjury, I certify that I have examined this form and attachments and to the best of my knowledge and

belief, it is true, correct and complete.

Signature of the holder authorizing

Date

the transfer of the credit.

Transferred to:

Name of new holder

SSN or FEIN

City, state and ZIP code

Mailing address

Under penalty of perjury, I certify that I have examined this form and attachments and to the best of my knowledge and

belief, it is true, correct and complete.

Signature of the holder to whom

Date

the credit is transferred.

TO BE COMPLETED BY THE NEW MEXICO TAXATION AND REVENUE DEPARTMENT

Date of approval of the credit:

Approved amount of rural job tax credit:

New credit number:

Rural job tax credit is approved as submitted.

Rural job tax credit is not approved. See the attached explanation.

Rural job tax credit is approved, but the amount of the credit has been adjusted. See the attached explanation.

Signature of Secretary or authorized delegate: __________________________________

Date: _____________________

Name (please print):_______________________________________

Title: ______________________________________

1

1